|

STEADY GROWTH The year 2017-2018 was

a growth oriented year for the UPS industry. Some comp-anies grew while

others failed to do so. Maintaining nearly the same growth as last year.

The industry netted revenues to the tune of INR

5930.87 crore. This is exclusively the end-user sales figure. However

the over all industry revenue was estimated at INR 6230.00 crore approx.

The reason why the total industry revenue is much higher then the

actual end-user sales is because many a companies procure finished

products from others & brand them as theirs, and our survey team gets

the turnover from both, resulting in duplication. With nearly 316

companies responding to our survey, giving us the information we sought

in great detail, knowing fully well how much the company has man-ufactured

with excise paid. And also trying to find out, which companies procure

finished products from others & brand them as theirs, an exercise which

We have been doing only since last few years, we did all of it again to

give continuity to the process.

Out of 316 companies responding only 179 companies were awarded with SD

Ratings.

However most of companies are facing it with ease to match quarter to

quarter sales of 17-18 in 18-19. We are sure the figure which we have

arrived at i.e. the actual end-user sales revenue of INR 6500.87 crore

mark will definitely be crossed with ease, in the current fiscal in

2018-2019.

(Our Midyear projection in June 2018)

Growth wise it has been a mixed year with some of the majors growing

while others dipping.

Revenue-wise : This year 2017-18, the industry grew by 8.96% &

revenues grew up to 5930.87 crores, a clear indicator that around 6%

growth in past years is over and even fiscal (2018-2019) the growth will

be over 7.0% to 9.0% for sure. Particularly very good, considering the

industry is getting itself to tune with GST.

Volume-wise : Industry grew by 19.7% over previous year in

volume terms. This clearly indicates shrinking margins in cases of

orders obtained thru tenders and sales to SI's.

One must be clear in mind that this is a very good performance

considering the stiff competition and the squeezed margins in view of

hammering the companies got during the global economic meltdown &

currently facing Indian Rupee slide and a strong dollar value.

Of the total revenue of 5930.87 crores, Online UPSs accounted for 88%

while Offline / Line interactive UPSs accounted for nearly 2%, while

other products including servos & change of batteries not under

maintenance accounting for the rest. We have not included the Home UPS

sales figure in this analysis . Sale of SPCUs has definitely picked up.

Of the total revenue organized sector accounted for nearly 79% while

21% came through semi organized and unorganized sector.

SD FINDINGS

Softdisk went about finding the state of the industry and also how

deep they were actually effected by GST. The first quarter of the

financial year 2017-18 were better than last year. Projects have been

few but the demands continue, There was a bit of lul in he second

quarter due GST implementations issues. in the current fiscal no major

projects came up during that period. The overall effect is putting

expansion plans on hold. However things improved in third quarter.

Growth for big IT, ITES & TELCOM segment even during recessionary trend

continued its positive trend for tower infrastructure. This has kept mid

segment market for UPS going well (up-to 200KVA). A small power data

center with power requirement of 20, 60 to 200KVA rating are also going

as per plans. The Industrial market segment covering Power, Energy,

Manufacturing, Steel, Cement, Oil & Gas, always experienced steady and

normal growth of of over 10%. The same is continuing in this year.

Softdisk believes that more and more people are moving towards Solar.

Some have even manufactured and installed Grid Sharing Solar UPS, with

hybrid charge facility (Photovoltaic & Mains).

With consolidation being the mantra for Industry. One can say the

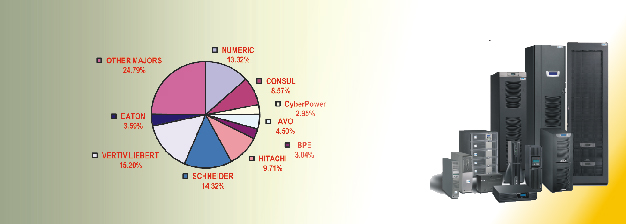

entire Online UPS market can be divided into following APC-Schneider,

Vertiv Liebert, Numeric, Hitachi, Consul, AVO, Eaton, CyberPower & Other

major players BPE, Socomec, Power One, Techser & Hykon & the rest.

Talking of market share Vertiv Emerson has the highest market share

of 15.20% followed closely by APC SCHNEIDER 14.32% Numeric 13.23%

followed by Hitachi 9.71% , Consul 8.57%, AVO 4.50%, Eaton 3.59 & so on

as shown in graph above. While other major players account for rest.

SD ESTIMATES

Softdisk had predicted in June 2017 that the total industry

revenue will touch INR 6000 crore mark by March, 2018. We talked to

Industry Captains trying to know what the Industry leaders thought. Many

had little or no doubt to what Softdisk has predicted earlier, even

though this response was at time when the global economies were trying

to come out of worst ever economic crises, and Indian market was also

undergoing GST implementation Impact. As on date we feel that nearing

5930.87 crore mark for end-user sales and 6230 crore mark including

secondary sales was quiet a close prediction. Softdisk remains committed

to transparent reporting, in-depth analysis and always throwing up

forecast & estimates which you can Rely Upon.

We have Faith, You Rely on

us, We Rely on facts..

According

to Mr. N K Agrawal of Delhi based Microtek in 2016-17 market has

witnessed slow down was a lot buoyant in 2017-18. This financial year

the economy world over is moving under the shadow of fear of major

recession in US trade war with China, depreciation of Chinese currency &

falling rupee has made the market slowdown further, it will not impact

Indian markets but spillover effect is showing its sign the falling

rupee is one such sign. In-spite of all this we still feel that the UPS

Segment will show a growth in this year also all though very low, he

laments. We have to give some time to the Govt at the center ringing in

changes by way of GST etc to bring back the economy back on track, he

adds. (Here it is worth mentioning that Softdisk figure does not include

the revenue generated by Inverters, which too is effected by the slow

down. ) According

to Mr. N K Agrawal of Delhi based Microtek in 2016-17 market has

witnessed slow down was a lot buoyant in 2017-18. This financial year

the economy world over is moving under the shadow of fear of major

recession in US trade war with China, depreciation of Chinese currency &

falling rupee has made the market slowdown further, it will not impact

Indian markets but spillover effect is showing its sign the falling

rupee is one such sign. In-spite of all this we still feel that the UPS

Segment will show a growth in this year also all though very low, he

laments. We have to give some time to the Govt at the center ringing in

changes by way of GST etc to bring back the economy back on track, he

adds. (Here it is worth mentioning that Softdisk figure does not include

the revenue generated by Inverters, which too is effected by the slow

down. )

Mr.

R K Bansal Managing Director Uniline Energy Systems Pvt. Ltd. elaborated

on this issue, according to him when we speak about market, we have an

enterprise market segment in mind. Most of the top notch UPS companies

like APC, Eaton, Numeric etc to some extent mostly serve this business

segment. Our strength lies in Govt. sector & PSUs. As per our

understanding, the market segment revenue (excluding precision A/C,

Electrical distribution, etc.) for UPS Systems is close to INR 4500 Cr.

Looking at the present market scenario, the revenue collection from this

segment shall be within INR 4500 to 5000 Crore in the current fiscal

this year. We had a tough time in last two fiscal, however things

improved in later part of last fiscal. This current year has been very

good, The expansion plans put on hold by most of the big names in IT,

ITES companies have started. Even the aggressive companies in IT

infrastructure segment are no exception. There is more emphasis on best

utilization of existing IT facilities and also human resource. Even the

Data Centers projects in telecom segment earlier put on hold have

started giving orders. Governments buying has also gone up as many a

governments projects have been put on hold have restarted. Mr.

R K Bansal Managing Director Uniline Energy Systems Pvt. Ltd. elaborated

on this issue, according to him when we speak about market, we have an

enterprise market segment in mind. Most of the top notch UPS companies

like APC, Eaton, Numeric etc to some extent mostly serve this business

segment. Our strength lies in Govt. sector & PSUs. As per our

understanding, the market segment revenue (excluding precision A/C,

Electrical distribution, etc.) for UPS Systems is close to INR 4500 Cr.

Looking at the present market scenario, the revenue collection from this

segment shall be within INR 4500 to 5000 Crore in the current fiscal

this year. We had a tough time in last two fiscal, however things

improved in later part of last fiscal. This current year has been very

good, The expansion plans put on hold by most of the big names in IT,

ITES companies have started. Even the aggressive companies in IT

infrastructure segment are no exception. There is more emphasis on best

utilization of existing IT facilities and also human resource. Even the

Data Centers projects in telecom segment earlier put on hold have

started giving orders. Governments buying has also gone up as many a

governments projects have been put on hold have restarted.

Fluctuation in rupee price not only raised import bills but also lead

to volatility affecting their businesses. Due to increase in raw

material cost, depreciating value of Indian Rupee, overall input cost

has increased. Considering the above facts, companies have increased

their product pricing. Local vendors cannot be matched up with

multinationals as they are not up to the mark in terms of international

standards, quality etc.

Cyber

Power follows the concept of economy of scale ensuring right product and

right quality. The company has a has a capacity of manufacturing UPS up

to 4800 kVA along with battery banks, harmonics filters, accessories and

allied products to provide an end to end power backup solution. UPS

assembly line is equipped with Cyber

Power follows the concept of economy of scale ensuring right product and

right quality. The company has a has a capacity of manufacturing UPS up

to 4800 kVA along with battery banks, harmonics filters, accessories and

allied products to provide an end to end power backup solution. UPS

assembly line is equipped with

- Latest equipments and fully automated test stations to perform

full range of parametric tests. Environment chamber to perform

UPS burn- in test at elevated temperature, Variable voltage and

frequency source for testing UPS as per practical site conditions

and simulating worst case utility conditions Pure resistive as well

as variable power factor load to perform UPS on full load test for

practically all conditions and get rid of any infancy failure in

UPS.

In addition to providing technologically superior, quality products

that meets the global standards, Cyber Power Solutions local

manufacturing at helps meet another dimension of business needs today -

On time and short delivery times. Current day business needs require

that projects are completed on time as projects overruns lead to an

unprecedented opportunity loss in Telecom, IT setups, Data Centers,

Medical establishments and Industry at large.

According

to Mr. Rajaram Ramamoorthy of Bangalore based E&C, having a stable

government at the centre will aid in better confidence for foreign

companies to invest in India. India has been an attractive destination

for long for several foreign companies, but the major problem has been

the red tape in conducting business as the laws of the land have been

inherently quite ambiguous even for Indian Companies and entrepreneurs.

But with the introduction of GST, things have been simplified.GST

subsumed various taxes like Excise, CST, VAT, Service Tax etc.. and it

is good that we have only one tax - GST. It is a year and after the

initial hiccups, there seems to be some order. While business is done

based on GST, the product / services prices have gone up and there seems

to be no coming back on the increased prices of some commodities /

Services. In a way, GST has helped some businesses to increase their

basic prices. According

to Mr. Rajaram Ramamoorthy of Bangalore based E&C, having a stable

government at the centre will aid in better confidence for foreign

companies to invest in India. India has been an attractive destination

for long for several foreign companies, but the major problem has been

the red tape in conducting business as the laws of the land have been

inherently quite ambiguous even for Indian Companies and entrepreneurs.

But with the introduction of GST, things have been simplified.GST

subsumed various taxes like Excise, CST, VAT, Service Tax etc.. and it

is good that we have only one tax - GST. It is a year and after the

initial hiccups, there seems to be some order. While business is done

based on GST, the product / services prices have gone up and there seems

to be no coming back on the increased prices of some commodities /

Services. In a way, GST has helped some businesses to increase their

basic prices.

While the GST law provides for the passing on the benefits of the

reduced taxes to the consumer, there can be no check on the margins that

every business can have on their products / services as that is a

business call.

The introduction of the Mixed Supply and Composite Supply has led to

a lot of doubts in the way that Products like UPS, which have a battery

component in it being interpreted as per the new definitions of Mixed &

Composite Supply. Since there is a tax difference between the UPS

Product and Battery (when sold alone), there could be a big tax impact

in case the interpretation is done wrongly as a Mixed Supply instead of

the Composite Supply. There is a widespread opinion in the minds of the

manufacturers, that what case laws based on legal judgements has been

applied in the excise regime is applicable in the GST regime as well.

Another thinking is also that there is no difference between a

manufacturer and a trader. Since the system is in its early stages,

there are too many doubts and risks involved when it comes to liability,

as the responsibility of levying the right percentage of GST lies with

the seller.

Since Department Assessments of GST has not started, and the GST law has

references to serious provisions under criminal law, it is very

pertinent for the department to take a very informed decision and not

harass the assesses based on their interpretations. Time has to be given

to the industry to get aligned with the settled interpretation of law.

It will be interesting to see how many cases and counter cases will be

filed once assessments are done and demands are made on assessees.

Already a number of businesses are facing severe cash flow problems and

with Banks also tightening their screws on their new working capital

norms, it appears that there are tougher times for MSMEs who are working

with limited resources.

Mr.

Narayan Sabhahit Managing Director, Techser Power Systems Pvt. Ltd,

Bangalore, believes that the financial year 2017-18 was a great year due

to high due to opening up of trade post GST. in the market and fierce

competition for top-line pie. Techser during the later part of the year

consciously decided to avoid any 'cut-throat' competition paradigm. We

diligently decided that it is better to work on healthy orders rather

that 'vanity orders' which could only boost top-line but adversely

affecting bottom-line. The year also has been a year of consolidation

with respect to our restructuring manufacturing and services offerings.

We tried to strengthen our work force wherever required so that we can

bounce back as the market became steadier. Some of the major forecasted

orders previous year did not materialize as there were unprecedented

delays in decision process. They spilled over to this financial year.

This reflected on our top-line during last year sales and boosted our

first quarter sales in 2017-18. Mr.

Narayan Sabhahit Managing Director, Techser Power Systems Pvt. Ltd,

Bangalore, believes that the financial year 2017-18 was a great year due

to high due to opening up of trade post GST. in the market and fierce

competition for top-line pie. Techser during the later part of the year

consciously decided to avoid any 'cut-throat' competition paradigm. We

diligently decided that it is better to work on healthy orders rather

that 'vanity orders' which could only boost top-line but adversely

affecting bottom-line. The year also has been a year of consolidation

with respect to our restructuring manufacturing and services offerings.

We tried to strengthen our work force wherever required so that we can

bounce back as the market became steadier. Some of the major forecasted

orders previous year did not materialize as there were unprecedented

delays in decision process. They spilled over to this financial year.

This reflected on our top-line during last year sales and boosted our

first quarter sales in 2017-18.

Hopefully we will be able to realize those trends in the current

fiscal. Our Indigenous drive is showing results both in new market and

service domain. We have launched Tech Glare product successfully and

geared up production. According to him "Today the development process in

every vertical is witnessing a speedy growth in the rural areas.

Interpretation of word 'development' in its correct form, has been taken

seriously by the concerned agencies / authorities. These are the areas

where continuity of power is very essential, since these companies are

facing the Global Challenges. Advent of GST has been very good but there

are certain implemental flaws.

While

Mr. Cristo George, MD of Thrissur, Kerela based Hykon India Pvt. Ltd.

believes that GST has been a big boost to the industry. After

Implementation of GST was a great relief for Hykon. The playing ground

became more flatter for all the companies. For Kerala UPS companies, GST

was a game changer. Before GST we were paying state Govt VAT 14.5% and

Central Excise duty 12.5% , ie - 27% total. This was a major hurdle when

competing with other state UPS companies and they were billing directly

to customers. Now GST made it 18% which is same all over the country.

The movement of goods after GST became easier and there is no need for a

godown in other states for billing purpose. So centralized warehouse is

sufficient for billing to anywhere in India. This has eased the

difficulties we were facing earlier. Before GST, taking UPS systems to

factory for servicing was a tedious process because of Central excise

formalities. With the implementation of GST the service center can be

located at factory which makes storage of components and administration

more easier Before GST collecting C-forms were a big headache. After GST

implementation, this was solved. Total Production cost also came down.

Many paper work were reduced which helped the Industry to have a better

bottom line. While

Mr. Cristo George, MD of Thrissur, Kerela based Hykon India Pvt. Ltd.

believes that GST has been a big boost to the industry. After

Implementation of GST was a great relief for Hykon. The playing ground

became more flatter for all the companies. For Kerala UPS companies, GST

was a game changer. Before GST we were paying state Govt VAT 14.5% and

Central Excise duty 12.5% , ie - 27% total. This was a major hurdle when

competing with other state UPS companies and they were billing directly

to customers. Now GST made it 18% which is same all over the country.

The movement of goods after GST became easier and there is no need for a

godown in other states for billing purpose. So centralized warehouse is

sufficient for billing to anywhere in India. This has eased the

difficulties we were facing earlier. Before GST, taking UPS systems to

factory for servicing was a tedious process because of Central excise

formalities. With the implementation of GST the service center can be

located at factory which makes storage of components and administration

more easier Before GST collecting C-forms were a big headache. After GST

implementation, this was solved. Total Production cost also came down.

Many paper work were reduced which helped the Industry to have a better

bottom line.

BIS certification is a welcome initiative by the government. This

will ensure that all goods are safe to be used by the end users. However

lack of testing centers / facilities coupled with vast inventory vide

importing by thousand of Indian vendors will make it extremely difficult

for importer to get a BIS certificate timely. However he does not think

so that BIS certification will throw out small players. Yes, may be fly

by night operators will be thrown out. I feel even if small time

manufacturer, if they have a good system with satisfactory procedures,

BIS certificate will be a blessing and eventually the BIS can be a big

tool to improve the small/medium manufacturer.

Shri

Rabindra Agrawal of Kolkata based Switching AVO Electro Power Ltd., also

believes that there is lot of good that has been brought in by GST

however tax rates for large backup systems are still point of concern.

The introduction of the Mixed Supply and Composite Supply has led to a

lot of doubts in the way that Products like UPS, which have a battery

component in it being interpreted as per the new definitions of Mixed &

Composite Supply. Since there is a tax difference between the UPS

Product and Battery (when sold alone), there could be a big tax impact

in case the interpretation is done wrongly as a Mixed Supply instead of

the Composite Supply. There is a widespread opinion in the minds of the

manufacturers, that what case laws based on legal judgements has been

applied in the excise regime is applicable in the GST regime as well. He

also believes that in Reverse auction there is an urge to become L-1

even if it is at the cost of going down on Bill of Materials. So all of

us must be alert and not bring down prices, just for the top line. We

must mature to the level of ensuring that we don't cut each other's

legs. He further adds that the market has been customer driven and price

plays a decisive role in most cases. Can we find a way out for UPS

Manufacturers staying away from such auctions? Can Customers be

explained the de-merits of reverse auction and the gain they will have

in normal tendering process. Yes, this is a must. The UPS and battery

suppliers should boycott reverse auctions. The battery suppliers must

not undercut the UPS OEMs and go direct to the same customers that UPS

OEMs helped develop for the battery suppliers. The UPS industry needs a

complete make-over. All manufacturers must get together and have a

common voice on this. Shri

Rabindra Agrawal of Kolkata based Switching AVO Electro Power Ltd., also

believes that there is lot of good that has been brought in by GST

however tax rates for large backup systems are still point of concern.

The introduction of the Mixed Supply and Composite Supply has led to a

lot of doubts in the way that Products like UPS, which have a battery

component in it being interpreted as per the new definitions of Mixed &

Composite Supply. Since there is a tax difference between the UPS

Product and Battery (when sold alone), there could be a big tax impact

in case the interpretation is done wrongly as a Mixed Supply instead of

the Composite Supply. There is a widespread opinion in the minds of the

manufacturers, that what case laws based on legal judgements has been

applied in the excise regime is applicable in the GST regime as well. He

also believes that in Reverse auction there is an urge to become L-1

even if it is at the cost of going down on Bill of Materials. So all of

us must be alert and not bring down prices, just for the top line. We

must mature to the level of ensuring that we don't cut each other's

legs. He further adds that the market has been customer driven and price

plays a decisive role in most cases. Can we find a way out for UPS

Manufacturers staying away from such auctions? Can Customers be

explained the de-merits of reverse auction and the gain they will have

in normal tendering process. Yes, this is a must. The UPS and battery

suppliers should boycott reverse auctions. The battery suppliers must

not undercut the UPS OEMs and go direct to the same customers that UPS

OEMs helped develop for the battery suppliers. The UPS industry needs a

complete make-over. All manufacturers must get together and have a

common voice on this.

The UPS being a technical solution which provides a lifeline for

today's business requirements and financial transactions should not be

treated as a commodity sale. But rather, as a technical offer which

provides "Power Continuity Solutions" and must be given its due respect.

Softdisk believes that UPS manufacturers

are supplying and installing a POWER CONDITIONING product, A CAPITAL

EQUIPMENT and not a box pushing activity. In the absence of a detailed

technical selling based on performance, reverse auction becomes a simple

number game for everyone. This will lead to killing the very industry

practice itself and the customers will realize this only few years

later. If this is for computer stationery (or) purchase of tube lights

etc then the reverse auction is Ok as most competitive bidder will sell

more.

According

to Mr. Y B Suresh of TPC Smaller players are finding it difficult to

access to new customer and volume based order because of the big players

are coming out with very competitive price and products ranges. According

to Mr. Y B Suresh of TPC Smaller players are finding it difficult to

access to new customer and volume based order because of the big players

are coming out with very competitive price and products ranges.

Earlier banks used to be priority customers but now with reverse

auction we are out of it. So, Small player should focus on providing

effective service support to retain their existing and grow in their

reference market and focus on providing complete solution to customers

and focus much on related products requirement in existing customer

base.

Softdisk believes that All said and done,

simple way out for UPS companies to avoid getting squeezed by customers

is to boycott all reverse auction.

Mr.

I B Rao & Mr. M R Rajesh of Power One Micro Systems Pvt. Ltd. welcomed

the implementation of GST today Indian power conditioning market is

getting more sensitive and mature to the evolving needs of the

businesses. With India assuming a key role in the world economy,

businesses have become attuned to the fact that they need to be robust

in terms of infrastructure to attract and retain investors. Hence,

Business Critical Continuity is being viewed strategically and upcoming

businesses are realizing the importance of factoring and aligning it as

key component in the overall business model. Mr.

I B Rao & Mr. M R Rajesh of Power One Micro Systems Pvt. Ltd. welcomed

the implementation of GST today Indian power conditioning market is

getting more sensitive and mature to the evolving needs of the

businesses. With India assuming a key role in the world economy,

businesses have become attuned to the fact that they need to be robust

in terms of infrastructure to attract and retain investors. Hence,

Business Critical Continuity is being viewed strategically and upcoming

businesses are realizing the importance of factoring and aligning it as

key component in the overall business model.

Adding further they say we view the present market scenario as an

opportunity to strengthen our company's presence in Industrial &

Government market segment.

Extremely

low prices are unsustainable if quality/service levels are to be

maintained. Price erosion beyond a point hurts all stake holders -

manufacturers, channel partners, customers, etc. If it continues beyond

a point it will lead to disastrous consequences for vendors. We have

taken a wise decision not to take up orders were we have to cut down on

margins this allowed to expand our product basket to SPCUs, and complete

solar power installation where we are very successful to a great extent

and the results are showing. Extremely

low prices are unsustainable if quality/service levels are to be

maintained. Price erosion beyond a point hurts all stake holders -

manufacturers, channel partners, customers, etc. If it continues beyond

a point it will lead to disastrous consequences for vendors. We have

taken a wise decision not to take up orders were we have to cut down on

margins this allowed to expand our product basket to SPCUs, and complete

solar power installation where we are very successful to a great extent

and the results are showing.

Growth in the economy will lead to the growth and increase in IT

spends of vertical like IT, ITES, manufacturing, BFSI and Government.

There by leading to the increased demand for the UPS systems in these

vertical.

According

to Mr. Sriram Ramkrishnan CEO of Consul Neowatt Power Solutions Pvt.

Ltd. believes that Now that the 1st year anniversary has passed after

GST implementation started, we do not see any major issues with GSTN.

While there were a number of challenges for a few months after GST

started when GSTN was not open for filings for many days in a month,

those issues appear to be behind us now. Also since the government is

currently not requiring the filing of GSTR-2 (monthly details of

purchases), the complications of matching supplier invoices has still

not become an issue which can cause a variety of challenges to GSTN.

Currently we are filing only GSTR-1 (Monthly sales) and GSTR-3 (monthly

return with the summarised details of sales, purchases, during the month

along with the amount of GST liability). According

to Mr. Sriram Ramkrishnan CEO of Consul Neowatt Power Solutions Pvt.

Ltd. believes that Now that the 1st year anniversary has passed after

GST implementation started, we do not see any major issues with GSTN.

While there were a number of challenges for a few months after GST

started when GSTN was not open for filings for many days in a month,

those issues appear to be behind us now. Also since the government is

currently not requiring the filing of GSTR-2 (monthly details of

purchases), the complications of matching supplier invoices has still

not become an issue which can cause a variety of challenges to GSTN.

Currently we are filing only GSTR-1 (Monthly sales) and GSTR-3 (monthly

return with the summarised details of sales, purchases, during the month

along with the amount of GST liability).

The government should simplify the GST to a fewer number of slabs and

the UPS should to at a 12% slab from current 18% GST slab. This

reduction in GST rate for UPS is well justified as today UPS is a

necessity for uninterrupted business operation and is a critical product

required for increasing productivity of Indian businesses and for

efficient operations of government priorities like Smart Cities,

Airports, Metros, Railways and Hospitals. This will reduce unnecessary

burden on customers whose services or output is charged at lower GST

slab than 18% and also for customers in segments like Hospitals who

cannot take an input credit on their capital purchases like UPS. Further

UPS and Battery should also be at the same GST slab as the battery is

integral for the UPS to serve its intended purpose of providing

uninterrupted power to the connected loads. Currently battery is under

the 28% slab and UPS is under 18% slab. This has caused certain

challenges when some customers purchase UPS with backup (i.e inclusive

of batteries) @18% slab while other customers want to purchase UPS

without backup @18% slab and batteries separately @28% slab.

The margin pressure is real in a mature market with a number of UPS

suppliers competing fiercely for market share. I see this as a challenge

which we have to face and this should drive innovation and efficiency to

benefit the customer. Ultimately, UPS suppliers who can meet market

price levels without compromising quality will win market share. This

has been our mantra and we have focused our R&D to develop UPS products

that meets customer requirements on price, performance and quality. But

I will add that the price levels we see in many government tenders mean

that the successful UPS vendor will have to live with very low margins

or even incur a loss for the sake of top line. In this context, we

decided to not participate in PSU BFSI business about two years back

because we realized that we were unable to meet the price levels we saw

in these tenders. In this context, government can look to classify

vendors in 3 categories based on their capabilities - technical ,

financial & service strengths. Depending on the project size and scope,

participation can be restricted to vendors who meet the minimum

criteria. This will help ensure we can avoid unrealistic pricing seen

today in government tenders and also allow all UPS vendors to get a

share of the available government business without compromising on

margins or quality.

According

to Mr. Shankar C Nagali of Managing Director of Cosmic Micro Systems,

India's GDP growth despite slowdown is currently hovering around 7

percent mark which gives us an indication of the industrial expansion

that is already started happening under this regime. The rigidity of the

Indian economy was reflected during global meltdown. GST implementation

has eased out taxation difficulties to great extent. According

to Mr. Shankar C Nagali of Managing Director of Cosmic Micro Systems,

India's GDP growth despite slowdown is currently hovering around 7

percent mark which gives us an indication of the industrial expansion

that is already started happening under this regime. The rigidity of the

Indian economy was reflected during global meltdown. GST implementation

has eased out taxation difficulties to great extent.

As UPS category rate in an economy that is already the world's fourth

largest in real terms (Purchasing Power Parity) is expected to grow the

faster then any other country barring China. The key factors for India's

growth in the UPS market are would be:

With customers moving towards Desktops and smart phones, Increase

Server sales will resulting in increased demand for UPS, which is not

happening at the required pace right now.

Increase penetration in C & D class cities has been is the reason for

the growth in the UPS market. Growth in the economy will lead to the

growth and increase in IT spends of vertical like IT, ITES,

manufacturing, BFSI and Government. There by leading to the increased

demand for the UPS systems in these vertical.

According

to Amitansu Satpathy, MD, Best Power Equipments India Pvt Ltd., today

Indian power conditioning market is getting more sensitive and mature

where they are concerned on space saving energy consumption & efficient

quality service to the evolving needs of the businesses. With India

assuming a key role in the Asian economy, businesses have become attuned

to the fact that they need to be robust in terms of infrastructure to

attract and retain investors. Hence, Business Critical Continuity is

being viewed strategically and upcoming businesses are realizing the

importance of factoring and aligning it as key component in the overall

business model. Adding further he says we view the present market

scenario as an opportunity to strengthen our company's presence in

various market segment. Extremely low prices are unsustainable if

quality/service levels are to be maintained. Price erosion beyond a

point hurts all stake holders - manufacturers, channel partners,

customers, etc. If it continues beyond a point it will lead to

disastrous consequences for vendors. We have taken a wise decision not

to take up orders were we have to cut down on margins this has lead to

increased profitability where we are successful to a great extent and

the results are showing. This new GSTN system of taxation though is very

useful but still commenting before complete implementation, GST Audit

etc will be pre-mature, however movement of goods to various part of the

country has been eased a lot, he laments. According

to Amitansu Satpathy, MD, Best Power Equipments India Pvt Ltd., today

Indian power conditioning market is getting more sensitive and mature

where they are concerned on space saving energy consumption & efficient

quality service to the evolving needs of the businesses. With India

assuming a key role in the Asian economy, businesses have become attuned

to the fact that they need to be robust in terms of infrastructure to

attract and retain investors. Hence, Business Critical Continuity is

being viewed strategically and upcoming businesses are realizing the

importance of factoring and aligning it as key component in the overall

business model. Adding further he says we view the present market

scenario as an opportunity to strengthen our company's presence in

various market segment. Extremely low prices are unsustainable if

quality/service levels are to be maintained. Price erosion beyond a

point hurts all stake holders - manufacturers, channel partners,

customers, etc. If it continues beyond a point it will lead to

disastrous consequences for vendors. We have taken a wise decision not

to take up orders were we have to cut down on margins this has lead to

increased profitability where we are successful to a great extent and

the results are showing. This new GSTN system of taxation though is very

useful but still commenting before complete implementation, GST Audit

etc will be pre-mature, however movement of goods to various part of the

country has been eased a lot, he laments.

According

to Mr. Vinod Kumar of Arvi Systems & Controls Pvt. Ltd., Bangalore

believes Govt.'s GST taxation at this point is a mixed bag, there are

goodies as well as lot of clarity needed. Counting on goodies he says

now GST made it 18% which is same all over the country. The movement of

goods after GST became easier and there is no need for a godown in other

states for billing purpose. So centralized warehouse is sufficient for

billing to anywhere in India. This has eased the difficulties we were

facing earlier. Before GST, taking UPS systems to factory for servicing

was a tedious process because of Central excise formalities. With the

implementation of GST the service center can be located at factory which

makes storage of components and administration more easier Before GST

collecting C-forms were a big headaches. After GST implementation, this

was solved. Total Production cost also came down. Many paper work were

reduced which helped the Industry to have a better bottom line. According

to Mr. Vinod Kumar of Arvi Systems & Controls Pvt. Ltd., Bangalore

believes Govt.'s GST taxation at this point is a mixed bag, there are

goodies as well as lot of clarity needed. Counting on goodies he says

now GST made it 18% which is same all over the country. The movement of

goods after GST became easier and there is no need for a godown in other

states for billing purpose. So centralized warehouse is sufficient for

billing to anywhere in India. This has eased the difficulties we were

facing earlier. Before GST, taking UPS systems to factory for servicing

was a tedious process because of Central excise formalities. With the

implementation of GST the service center can be located at factory which

makes storage of components and administration more easier Before GST

collecting C-forms were a big headaches. After GST implementation, this

was solved. Total Production cost also came down. Many paper work were

reduced which helped the Industry to have a better bottom line.

On the inconvenient part Servers are not supporting the volume and

hence they are slow. The Govt should accept this and improve the

infrastructure. Filing of GST returns are not business centric. They are

bureaucracy centric. Repeated entry of date in various form makes it is

lot of over work. GSTR-3B should be sufficient and GSTN backend should

be able to extract all other forms from the same. The information has to

be easy for any business to enter their details and the backend of the

GST system should extract the data that the Government / bureaucrats

need. Service Tax which was at 15% has become 18% GST, which is a bigger

burden. Customers are refusing to pay this higher tax and hence the

basic price of the service is taking a hit.Service Invoices are due to

pay GST at the time of billing and Customers seldom pay the invoices on

time. Hence there is a larger working capital required to be compliant

with the system. Increased tax and a corresponding increase in working

capital leads to higher interest costs. Its just completed first year,

with people will get used to the system and Govt. co-operate in making

GSTN businesses friendly.

Mr.

Palash Nandy has 29 years of rich experience in Sales, Marketing and

Strategic Planning at Legrand, Who joined the Legrand group in 1990 as a

Sales Trainee in Kolkata. Subsequently he has many positions in Sales

and Marketing in India. His last assignment before Numeric was at the

Group HQ in France as Group VP Strategic Planning. Effective July 2016

he has taken over as CCO of Numeric which is a group brand of Legrand.

According to him Softdisk is the oldest and largest circulated magazine

and it gives a wide range of information from latest product news to

in-depth articles on power electronic industry and its reviews &

forecasts. The publication has been conducting surveys in the various

segments of Power, Solar & IT Industry and coming up with SD Awards.

These surveys provide an in-depth analysis of the some segments of the

Industry and users utilize it as one of their decision making tools and

also as a guide of the Industry. Mr.

Palash Nandy has 29 years of rich experience in Sales, Marketing and

Strategic Planning at Legrand, Who joined the Legrand group in 1990 as a

Sales Trainee in Kolkata. Subsequently he has many positions in Sales

and Marketing in India. His last assignment before Numeric was at the

Group HQ in France as Group VP Strategic Planning. Effective July 2016

he has taken over as CCO of Numeric which is a group brand of Legrand.

According to him Softdisk is the oldest and largest circulated magazine

and it gives a wide range of information from latest product news to

in-depth articles on power electronic industry and its reviews &

forecasts. The publication has been conducting surveys in the various

segments of Power, Solar & IT Industry and coming up with SD Awards.

These surveys provide an in-depth analysis of the some segments of the

Industry and users utilize it as one of their decision making tools and

also as a guide of the Industry.

CONCLUSION :

Softdisk believes that being a negligible

contributor to the GDP, Power Electronic Industry does not receive

enough attention from the Govt., we believe the Govt. should realize the

importance of Power Continuity as it is the life line of major GDP

contributors. Softdisk has seen it all over the past two & a half

decades, more often then not some of the companies use a lot of word

jugglery in there promos, it must be the same thing which some one else

must be offering without making lot of noise and at a better price. It

is one area where customers need to be watchful. Softdisk believes that

if Manufacturers mad rush for sale will only decrease their profits and

ultimately lead to their collapse. So UPS business is not rosy and

bright but has still not lost its potential.

|