|

Buoyant 2010-11, followed by sluggish 2011-12 (First

two Quarters)

The year 2010-2011 saw the industry netting revenues to

the tune of INR 4134 crores. This is exclusively the end-user sales

figure. However the over all industry revenue was estimated at INR 4600

crores. The reason why the total industry revenue is much higher then the

actual end-user sales is because many a companies procure finished

products from others & brand them as theirs, and our survey team gets

the turnover from both, resulting in duplication. With nearly 312

companies responding to our survey, giving us the information we sought in

great detail, knowing fully well how much the company has manufactured

with excise paid. And also trying to find out, which companies procure

finished products from others & brand them as theirs, an exercise

which We have been doing only thrice before, we did all of it again to

give continuity to the process. Out of 312 companies responding only

181 companies were awarded with SD Ratings. However most of companies

are facing it difficult to match quarter to quarter sales of 2010-11 in

2011-12.

We are sure the figure which we have arrived at i.e.

the actual end-user sales revenue of has definitely crossed INR 4100.00

crore mark .

Growth wise it has not been a good year for most of the

majors with a few exceptions.

Revenue wise : Industry grew by 14 % a raise of

over 5% over the last fiscal of 2009-2010.

Volume wise : Industry grew by 27% over previous

year. This clearly indicates shrinking margins.

One must be clear in mind that this is a very good

performance considering the stiff competition and the squeezed margins in

view of hammering the companies got during the global economic meltdown.

Of the total revenue of 3905 crores, Online UPSs

accounted for 91% while Offline / Line interactive UPSs accounted for

nearly 7% while other products including Servos accounting for the rest.

We have not included the Home UPS sales figure in this.

Of the total revenue organized sector accounted for

nearly 61% while 25% came through semi organized sector while 14% share

still remains with the unorganized fly by night operators.

SD FINDINGS

Softdisk went about finding the state of the industry

and also weather they was actually out of recession, The last two quarters

of the second half were actually very good probably pumped by Govt.

buying. ITES companies like Call centers are badly hit. The overall effect

is putting expansion plans on hold. They have given more stress on best

utilization of their existing facility and infrastructure. Almost flat

growth for big IT companies. However, the growth continued to some extent

in telecom segment. The large telecom data center business though slowed

down in pace, however, exhibiting positive trends. The telecom segment

even during recessionary trend continued its positive trend for tower

infrastructure. This has kept mid segment market for UPS going well (up-to

200KVA). A small power data center with power requirement of 20, 60,

200KVA rating are also going as per plans. The Industrial market segment

covering Power, Energy, Manufacturing, Steel, Cement, Oil & Gas,

always experienced steady and normal growth of 12-14%. The same is

continuing in this year. Softdisk believes that more and more people are

moving towards Solar. Solar PCUs units are the new mantra for the UPS

Companies, some have even manufactured and installed Solar UPS, with

hybrid charge facility (Photovoltaic & Mains).

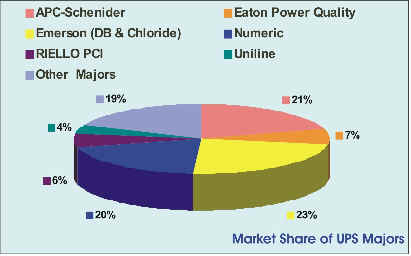

With

consolidation being the mantra for Industry. One can say the entire Online

UPS market can be divided into following APC-Schneider, Emerson (Cloride

&DB), Eaton, Numeric, PCI, Uniline, Other Major players (Hi-Rel,

Consul, Power One, Delta, Tritronics, Techser & Hykon) & the rest.

Talking of market share Emerson has the highest market share of 24%

followed closely by APC Schneider 21, Numeric 20%, Eaton 7%, Riello PCI 6%

while other major players account for 22%. With

consolidation being the mantra for Industry. One can say the entire Online

UPS market can be divided into following APC-Schneider, Emerson (Cloride

&DB), Eaton, Numeric, PCI, Uniline, Other Major players (Hi-Rel,

Consul, Power One, Delta, Tritronics, Techser & Hykon) & the rest.

Talking of market share Emerson has the highest market share of 24%

followed closely by APC Schneider 21, Numeric 20%, Eaton 7%, Riello PCI 6%

while other major players account for 22%.

SD ESTIMATES

Softdisk went about asking that its prediction in July

2011 that the total industry revenue will cross INR 5000 crore mark by

March, 2013 trying to know what the Industry leaders thought. Many had

little or no doubt to what Softdisk has predicted earlier, even though

this response was at time when the global economies were trying to come

out of worst ever economic crises, and Indian market was also shaken by

it. Buoyant by previous years performance many even predicted the industry

revenue to touch 6000 mark by March 2013. But as on date we feel that

crossing 5000 crore mark barrier for end-user sales and 6000 crore mark

including secondary sales is quite possible. Although few may disagree to

the secondary figures, but being optimistic has always been the Softdisk

attitude.

To the SD’s question 2010-11 Market was upbeat, But

first two quarters are showing steady progress nothing flashy, why ?

According to Mr. N K Agrawal of Delhi based Microtek

International Pvt. Ltd., There is a Great Market potential as these

products UPS and Inverters have become an essential part of every

household, and as the middle class is growing rapidly in India the

consumption of these products is also growing at the same pace. We do see

sales of these products not only meeting but exceeding by a large number

the Softdisk prediction of UPS industry revenues reaching INR 6000 Crore

by 2013. (Here it is worth mentioning that Softdisk figure does not

include the revenue generated by Inverters).

Mr. Agrawal feel agrees that in 2010-11 market had been

very buoyant, This financial area the economy world over is moving under

the shadow of fear of major recession in us and Europe, because of this

the things have slowed down, it will not impact Indian markets but

spillover effect is showing its sign. In-spite of all this we still feel

that the UPS Segment will show a growth in this year also, he laments.

While Mr. Cristo George, MD of Thrissur, Kerela based

Hykon India Pvt. Ltd. believes that after experiencing severe declines

following the global recession in 2009, the UPS market turned around in

2010 with revenues higher than in 2009. But the market has experienced ups

and downs over the past year. The consumer PC market more bent towards

larger notebook adoption makes the intake restricted only to the desktop

users who mostly settle for 0.5KVA to 1KVA power back devices.

Uninterruptible Power Supplies grew twice as fast in the second half of

2010 compared with the first half of that year. The market continues to

recover swiftly from the economic downturn with revenues in 4th quarter

being 10.8% higher than the same period in 2009 because sales of large

three phase UPS for enterprise data centers spiked in the 4th quarter.

Mr. R K Bansal Managing Director Uniline Energy Systems

Pvt. Ltd. elaborated on this issue, according to him when we speak about

market, we have an enterprise market segment in mind. Most of the top

notch UPS companies like APC, Eaton, Numeric, PCI to some extent mostly

serve this business segment. Our strength lies in Govt. sector & PSUs.

As per our understanding, the market segment revenue (excluding precision

A/C, Electrical distribution, etc.) for UPS Systems is close to INR 4500

Cr. Looking at the present market scenario, the revenue collection from

this segment shall be within INR 5000 to 5100 Crore in the current fiscal

this year.

Even after a year of slump, economic slow down has

adversely affected IT and IT infrastructure segment. The expansion plans

are put on hold by most of the big names in IT, ITES. Even the aggressive

companies in IT infrastructure segment are no exception. There is more

emphasis on best utilization of existing IT facilities and also human

resource. Even the Data Centers projects in telecom segment with few

exceptions are either postponed or put on temporary hold. However we see a

shift now, In last six months the demand for high power UPSs above 200KVA

has gone up considerably. The situations now is wait and watch and do the

things as they unfold. As of Uniline the economic recession has not

affected. We expect more business from these segments and continue to

maintain our growth. Apart from this, some business revenue is also

expected from specialized Solar products what we manufacture for niche

market. This shall also contribute to our growth plan.

Mr. Narayan Sabhahit Managing Director, Techser Power

Systems Pvt. Ltd, Bangalore, believes that The average market in

enterprise segment (in which we operate) is expected to grow at the rate

of 15 -20%. The data center market is expected to see a growth of 20 - 25%

as compared to last year. However, the remaining IT market growth is

expected to the tune of 10 - 12%. Last few years the growth rate in the

market has been encouraging (Leave apart the slowdown period) and UPS

shipments taking a cue from the PC market have also witnessed a very

significant growth. He further adds, the UPS penetration is now taking

place in cities and towns outside the top 20 cities. According to him “Today

the development process in every vertical is witnessing a speedy growth.

Interpretation of word ‘development’ in its correct form, has been

taken seriously by the concerned agencies / authorities. The

Infrastructure development required to address the challenges of 21st

century is being put in to place. This is a good sign to a certain extent

Government is also keen in making efforts towards enduring availability of

Power. What we see today may not be looking very rosy form the Govt., but

I am sure with nuclear deal and nuclear reactors coming up there will big

orders from companies like ECIL, BHEL, BEL and the likes. “We at Techser

are fully geared to latch on the opportunities when it presents.” As

always, Quality of the product & support package will remain paramount

to us.”, he laments.

Speaking on the overall scenario of the industry Mr.

Sabhahit believes that all this put together, there is growth pattern

happening. These are the areas where continuity of power is very

essential, since these companies are facing the Global Challenges. And

hence the demand for the UPS and Complete Power solutions is on the rise.

Speaking on the recessive trend in the first two

quarter, Mr. Suhas Joshi Director (MCIS) Delta says that current economic

situation is turbulent and to some extent Indian market is also affected

because of the impact on European market which is showing a dip. But

government, education, ITes market is growing. Earlier the market was

growing at 15-20% growth rate. Now it is growing about 8-10%. Organizations

have entered a new era characterized by rapid, dramatic and turbulent

changes. The accelerated pace of change has transformed the way a work is

performed by employees in diverse organizations. The most common business

strategy adopted by almost every organization is to think globally but act

locally as it helps to deal with the challenges of doing business in the

globalized economy. Delta Power Solutions has also adopted methodology on

similar lines laments Mr. Joshi.

Mr. R Chellapan of Numeric Power Systems Ltd. feels,

Softdisk has more scientific way of evaluating the market for its volume

and quality then any other agency and the overall UPS sales by 2012 might

cross 5000 Cr mark subject to IT recovery. He believes that first two

quarters of 201111-12 have been OK, not that bad as projected by many. He

feels that for manufactures it is not that much of a problem, it is the

week India Rupee against US$ which is cause of concern of importers.

NUMERIC, which has been the leader in the UPS industry,

has taken larger initiatives with most modern manufacturing infrastructure

to address the mass production requirements and geographically expanded to

over 259 locations as of now.

With India assuming a key role in Asia, businesses have

become attuned to the fact that they need robust infrastructure to attract

and retain investors for this having power continuity & quality are

paramount.

On the question of Reverse Auction, Mr. Chellappan

was critical : The entire industry must boycott reverse auction without

any exception. Reverse auction makes everyone to cut the others leg and

their own as well since there is pressure in the minds of the

participants. In reverse auction there is no scope for any company to

present their strengths like : PRODUCT SPECIFICATIONS, R&D

CAPABILITIES, MANUFACTURING & QUALITY SYSTEMS, ROLL-OUT ACROSS INDIA,

INSTALLATION & SAFETY TO CUSTOMER EQUIPMENTS, SYSTEMS PERFORMANCE,

UP-TIME & BUSINESS CONTNUITY, OTHER SUPPORT FUNCTIONS.

He further adds : After all we are

supplying and installing a POWER CONDITIONING product, A CAPITAL EQUIPMENT

and not a box pushing activity. In the absence of a detailed technical

selling based on performance, reverse auction becomes a simple number game

for everyone. This will lead to killing the very industry practice itself

simply and the customers will realize this after few years later. If this

is for computer stationery (or) purchase of tube lights etc then the

reverse auction is Ok as most competitive bidder will sell more.

According to MR. Rajaram Rammurthy MD, Electronics

& Controls Power System Pvt, Ltd. : The reverse auction process is not

a favourable option for the customer as well as the UPS Manufacturers. (1)

No. of participants are not known. (2) Genuineness of the participants are

not known (sometimes customer plays proxy to put pressure on the other

suppliers), names of companies participating in the tenders are not known.

Etc., The reverse auction is a forced and rapid price reduction tactics.

In the quest for more business volumes, unreasonable bids are made leading

to commercial unavailability of supply. It is also a possibility that the

customer is affected by this process. In addition, the bidding process is

very time consuming.

Will all companies cooperate in boycotting? Since there

are a few companies participating in such reverse auctions, I suggest that

all companies boycott by signing a declaration, either under the auspices

of “Association UPS Manufacturers”, or “UMDA”, or “Softdisk”,

which can be sent to such customers to communicate the boycott. That would

be ideal. However, one needs to be firm on the threats from such customers

blacklisting the boycotters.

According to Mr. Anoop Nanda, MD, Eaton Power Quality

India Pvt. Ltd. Reverse auction is not suitable for customized solutions,

which is what UPS selling has now become. We believe that buying UPS

starts from conducting a Power audit, determining specific loads, and then

proposing a solution which includes proprietary softwares and patented

technologies. He says A reverse auction bundles apples with oranges,

notwithstanding if it’s appropriate for the buyer or not. I also think

that tendering is a more transparent process and it takes into account the

vendor history with an emphasis on solutions, laments Mr. Nanda.

Mr. N P Krishnan, Director Marketing of Consul

Consolidated Pvt. Ltd. Believes that in Reverse auction there is an urge

to become L-1 even if it is at the cost of going down on Bill of

Materials. So all of us must be alert and not bring down prices, just for

the top line. We must mature to the level of ensuring that we don’t cut

each other’s throat.

He further adds that the market has been customer

driven and price plays a decisive role in most cases. With volatile lead

prices leading to fluctuating battery prices it will be difficult to

sustain low prices. Customer demands have become unrealistic which are

difficult to meet at prevailing prices and payment terms – asking for

3-5 years warranty / life of batteries which battery manufacturers do not

provide. AMC rates are also very low which will lead to poor

sustainability. In addition, the UPS is losing its respect and stature as

a product. The UPS industry needs a makeover.

More or less similar view were expressed by Mr. P K

Gopalakrishnan, CEO of WeP Peripherals. According to him in reverse

auction the vendors will be squished to the maximum from the customers and

due to high competition might end up in narrow margin . In regular tender

we know what the margin is and what all services or support we will give

to customers. Clients also must realize the support they will be requiring

till the life of the product and must not encourage this practice.

Softdisk believes that All said and done, simple way

out for UPS companies to avoid getting squeezed by customers is to boycott

all reverse auction.

The Market & Price pressure :

According to Mr. I B Rao & Mr. M R Rajesh of Power

One Micro Systems Pvt. Ltd. today Indian power conditioning market is

getting more sensitive and mature to the evolving needs of the businesses.

With India assuming a key role in the Asian economy, businesses have

become attuned to the fact that they need to be robust in terms of

infrastructure to attract and retain investors. Hence, Business Critical

Continuity is being viewed strategically and upcoming businesses are

realizing the importance of factoring and aligning it as key component in

the overall business model.

In India, the five cities of Mumbai, New Delhi, Chennai,

Kolkata and Bangalore have been the largest markets for power products.

However, there has been a shift towards B & C Class cities such as

Pune, Chandigarh, Lucknow, Hyderabad, Jaipur to name a few. These

locations are fast becoming global hubs in terms of R&D, ITES &

BPO, Retail, and Manufacturing and given the criticality of operations

undertaken in these sectors, there is an increasing need for comprehensive

network uptime solutions, Besides, given the upward spiral in terms of PC

penetration in these cities, these cities have been showing a marked

growth, they laments. Adding further they say we view the present market

scenario as an opportunity to strengthen our company’s presence in

Industrial market segment. Extremely low prices are unsustainable if

quality/service levels are to be maintained. Price erosion beyond a point

hurts all stake holders – manufacturers, channel partners, customers,

etc. If it continues beyond a point it will lead to disastrous

consequences for vendors.

Mr. Ramesh S Managing Director, Powertronix Ltd.,

Bangalore, believes that “In the past past year the net materials cost

of all the products gone up and we are taking all cost cutting measures to

control the pricing and offer great value to customers.” We are doing

reverse engineering and research to check all the possibilities to reduce

cost without compromising on quality, he laments. He further adds when we

fixed expenses to keep the cash flow going, some people started quoting

very low. But surely they can not repeat and sustain but certainly some of

listed companies could do it for long time. That is to play a different

game to keep the share price high. Even they have to revert back at some

point of time.

Tejas Sheth of Asia Powercom is of a different view, he

believes that price volatility has hit the mid sized players more then

their un-organized peers. We maintain offices at various location which

increases our overhead, smaller/local player does not have to care about

all these things and is not hurt to any extent. He further adds as far as

recession is concerned worst is over, the growth rate will not be rosy in

future any more & one has to be ready to face the stiff competition.

We have seen even bigger player foraying into unknown territories as far

as the product diversification is concerned. Going Solar is a prime

example. Further the UPS penetration is now taking place in cities and

towns outside the top 20 cities which further increases the over heads and

makes sustainability difficult.

According to Mr. Shankar C Nagali of Managing Director

of Cosmic Micro Systems, India’s GDP growth despite slowdown is

currently hovering around 6% mark which gives us an indication of the

industrial expansion that is already happening at a rapid pace. The

rigidity of the Indian economy was reflected during global meltdown. As

such in the growth of the UPS category. This growth rate in an economy

that is already the world’s fourth largest in real terms (Purchasing

Power Parity) is expected to grow the faster then any other country

barring China. The key factors for India’s growth in the UPS market are

would be:

- Increase in PC & server sales resulting in increased demand for

UPS.

- Increased penetration in B, C & D class cities has been another

reason for the category growth.

- Growth in the economy will lead to the growth and increase in IT

spends of verticals like IT, ITES, manufacturing, BFSI and Government.

There by leading to the increased demand for the UPS systems in these

verticals.

- Increased awareness for quality of power has also boosted the demand

for UPS systems. UPS provides protection against voltage fluctuations

and low voltage.

NORMS OF THIRD PARTY MAINTENANCE

Mr. Rajaram Murthy of Electronics & Controls

Systems Pvt. Ltd. : Third party servicing is considered by customers to

reduce the cost of maintenance and ease of accessing the maintenance

personnel. Though it may appear as a good option, the assumption that

customer makes is that all UPS are serviceable by anybody, which often is

not the case. It always depends on the type and technology of the UPS as

well as the ability of the third party.

There are risks for the third party taking the AMC on

as is where is basis, especially when the spread is too high. It is not

practically possible to understand the working status of the UPS and can

lead to severe loss and poor sustainability of the third party company if

the UPS are not in working condition or if the spare parts are not

available.

Customers have to pay higher service charges in case of

award of a UPS for service to other than the OEM due to risks of providing

standbys or having to replace the UPS in case of non-maintainable

conditions. Third Party Servicing is prevalent mostly in Banks. It is

obvious that they are the ones who are benefited in the process.

Softdisk believes that UPS Manufacturers should come up

with say No to TPM, unless the company that had sold the machine refuses

to maintain the machine. This should be binding on all Manufacturers. This

practice if persuaded with not only make Servicing an assured income and

bring revenue to the company on the other hand customer will have longer

life for its system as similar & not substitutes parts will be used to

replace the faulty component.

ON THE TAXATION FRONT

Divergent view were expressed by on taxation front.

Where one segment believes that UPS imports should be exempted for taxes

the segment talks of protecting the interest of Indian UPS Manufactures.

According to Mr. Anil Munjal of Riello PCI Ltd.

believes Govt. should considering the importance of UPS systems in a

growing economy and keeping in view the power Scenario what it is, the

Govt. should certainly exempt all UPS systems from import duties Customs

Duties, excise duties etc. Although “The government is

quite conscious of the power scenario in the country, yet it seems that

all the new addition to the installed capacity do not gives us the comfort

of continuous power even by the year 2012. Despite this grave situation,

there are no special incentives or support for the UPS installation except

in a very limited way. Considering the importance of UPS Systems in a

growing economy and keeping in view the power scenario what is it, the

Govt. should certainly exempt all UPS Systems from import duties and

excise duties” , he laments.

After all, What will an importer or manufacturer do

with UPS Systems or batteries except to use them for ensuring continuous

good power quality and help to generate more affordable and help cut cost

for our manufacturing and services and thus make them somewhat more

competitive globally, he adds.

Mr. Suhas Joshi, of Delta Energy believes government

must consider reducing various formalities which consumes lot of time.

Online facility should be encouraged as it saves lot of time, ensuring

paperless and green monitoring. Manufacturers like Delta face lot of

difficulty and cost bearing on intrastate movement. Transport checks at

multiple checkpoints needs to be reduced, he laments.

On a milder note Mr. Thomas Koshy, Direct Hykon India

Pvt. Ltd., Although there is a definite reduction in the excise duty the

threat we may face in the future will be MNC directly entering and

targeting the end customers. US & UK companies may come up as a major

threat in the next 2 years as things stand today. Here the government

should think of giving an edge to the Indian manufacturers by way of

imposing duties and levies to MNC products. We agree that more players

(both abroad & indigenous) will do better choice for the customers but

should come out with definite plans for encouraging the Indian

manufacturers, he lament.

Those who encourage protecting the interest of Indian

UPS Manufacturers believe that when it come to taxation, Mr. Sumant Kumar,

Director Powernet Solutions suggest that Back-up systems called by various

names like On-Line UPS, Static Converters, Line Interactive UPS,

Inverters, Home UPS to be classified under a single heading, with a VAT

applicable @5%. In many states of India the Taxation has been at 5% on UPS

and 14 % on Inverters. Though there are changes in Design & Technology

of the various products mentioned, the application is almost same. If we

maintain a common Taxation on all the above products mentioned above, we

can prevent confusion among the taxation authorities, UPS dealers and

manufacturers.

According to Mr. R V Vinod, Managing Director Arvi

Systems & Controls Pvt. Ltd. believes that Barrier to Entry for

Multinationals should be increased from current levels. Currently, there

is not much of a barrier as Government wants to increase foreign

investment as well as increasing bilateral trade. Multinational companies

enjoy better subsidies compared to Indian manufacturers – especially

difficult for Indian UPS Companies which are entrepreneur led with limited

financial capacity. Government should consider alternate mechanisms for

Banks and Governments (which currently do not provide road permits for

supply to them in Road Permit requiring states) to procure products from

across states thereby not forcing companies to register for sales tax.

MOVING TOWARDS ALTERNATIVE ENERGY SOLUTIONS

Mr. R Chellappan of Numeric Power Systems believes that

there is no other alternative than to explore alternate technology. This

can be in the area of Solar. “We have developed a Solar Hybrid UPS,

which is doing exceedingly well.”, we are the first and only UPS

manufacturer which has a fully Solar Powered fabrication plant in Chennai,

he proudly laments. Our total installed capacity in Solar may well exceed

500 KWp. To further the growth of our Green Energy projects we have

created a wholly owned subsidiary named Numeric Solar Pvt. Ltd.

We have successfully commissioned over 2MWp solar

projects involving various capacities in last two year. Earlier we had

installed 10KWp Solar Project with a 2 way inverter using MPPT Technology

in Kenya and another 8 KW plant in Japan. He is quick to add we have

revisited feature-value equations for customers to try and optimize

wherever possible. There by coming up with Offgrid, Hybrid tie solutions

for all sorts of application. We ensure the value we provide to customers

remain optimized.

Techser are another company foraying into Solar market.

They have installed over 200KWp in last fiscal. Tritronics have installed

& Commissioned Solar UPSs in Rajasthan Schools. Powertronix, Uniline,

PowerOne, Hykon all trying their hand in the Solar Energy Solutions

Market. Go Green seems to be the new mantra for UPS Manufacturers.

CONCLUSION :

Softdisk believes that being a negligible contributor

to the GDP, Power Electronic Industry does not receive enough attention

from the Govt., we believe the Govt. should realize the importance of

Power Continuity as it is the life line of major GDP contributors. Finally

it all boils down to service, companies with better service infrastructure

will always survive. We have seen even the companies offering Chinese

product doing well as they are at the top when it comes to services.

Softdisk has seen it all over the past two decades,

more often then not some of the companies use a lot of word jugglery in

there promos, it must be the same thing which some one else must be

offering without making lot of noise and at a better price. It is one area

where customers need to be watchful. From the customer point view, we have

a complete chart prepared, what to do while purchasing a UPS.

Some current technology trends are:

-

Green technology

-

High efficiency machines reducing operating

expenses

-

Less harmonics from UPS resulting in low pollution

of utility

-

Highest power to footprint ratio which will lower

real estate costs

Softdisk believes that if Manufacturers mad rush for

sale at any cost continues, one cannot expect a growth of 25-30% as it

used to be but settle for 12-14% growth, atleast for next two years,

unless some thing miraculous happens. So UPS business is not rosy and

bright but has still not lost its scent. |