|

STEADY GROWTH

The year 2016-2017 was a flat year for the UPS industry. Some

companies grew while others failed to do so. Maintaining nearly the same

growth as last year. The industry netted revenues to the tune of INR

5442.87 crore. This is exclusively the end-user sales figure. However

the over all industry revenue was estimated at INR 5700.00 crore approx.

The reason why the total industry revenue is much higher then the

actual end-user sales is because many a companies procure finished

products from others & brand them as theirs, and our survey team gets

the turnover from both, resulting in duplication. With nearly 331

companies responding to our survey, giving us the information we sought

in great detail, knowing fully well how much the company has

man-ufactured with excise paid. And also trying to find out, which

companies procure finished products from others & brand them as theirs,

an exercise which We have been doing only since last few years, we did

all of it again to give continuity to the process.

Out of 331 companies responding only 179 companies were awarded with SD

Ratings.

However most of companies are facing it with ease to match quarter to

quarter sales of 16-17 in 17-18. We are sure the figure which we have

arrived at i.e. the actual end-user sales revenue of INR 5700.00 crore

mark will definitely be crossed with ease, in the current fiscal in

17-18. Growth wise it has been a mixed year with some of the majors

growing while others dipping.

Revenue-wise : This year 2016-17, the industry grew by 6.27% &

revenues grew up to 5442.87 crores, a clear indicator that less than 5%

growth in past years is over and even fiscal (2017-2018) the growth will

be over 6.5% to 7.0% for sure. Even though industry is getting itself to

tune with GST.

Volume-wise : Industry grew by 16.0% over previous year in

volume terms. This clearly indicates shrinking margins in cases of

orders obtained thru tenders and sales to SI's. One must be clear in

mind that this is a very good performance considering the stiff

competition and the squeezed margins in view of hammering the companies

got during the global economic meltdown & currently facing Indian Rupee

slide and a strong dollar value.

Of the total revenue of 5442.87 crores, Online UPSs accounted for 93%

while Offline / Line interactive UPSs accounted for nearly 3%, while

other products including servos & change of batteries not under

maintenance accounting for the rest. We have not included the Home UPS

sales figure in this analysis .

Of the total revenue organized sector accounted for nearly 79% while

21% came through semi organized and unorganized sector.

SD FINDINGS

Softdisk went about finding the state of the industry and also how

deep they were actually effected by demonetization and GST, The first

two quarters of the financial year 2017-18 were better than last year.

Projects have been few but the demands continue, in the current fiscal

no major projects came up baring a few. The overall effect is putting

expansion plans on hold. They have given more stress on best utilization

of their existing facility and infrastructure. Growth for big IT, ITES &

TELCOM segment even during reversionary trend continued its positive

trend for tower infrastructure. This has kept mid segment market for UPS

going well (up-to 200KVA).

A small power data center with power requirement of 20, 60 to 200KVA

rating are also going as per plans. The Industrial market segment

covering Power, Energy, Manufacturing, Steel, Cement, Oil & Gas, always

experienced steady and normal growth of 10-12%. The same is continuing

in this year. Softdisk believes that more and more people are moving

towards Solar. Solar PC units are the new mantra for the UPS Companies,

some have even manufactured and installed Grid Sharing Solar UPS, with

hybrid charge facility (Photovoltaic & Mains). With consolidation being

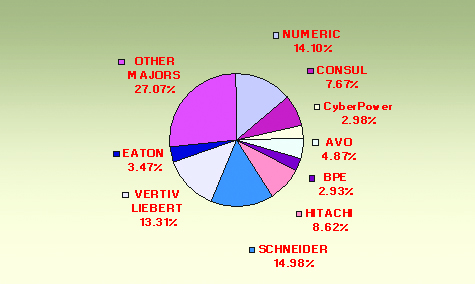

the mantra for Industry. One can say the entire Online UPS market can be

divided into following APC-Schneider, Vertiv Liebert, Numeric, Hitachi,

Consul, AVO, Eaton, CyberPower & Other major players BPE, Socomec, Power

One, Techser & Hykon & the rest. Talking of market share APC SCHNEIDER

has the highest market share of 14.98% followed closely by Numeric 14.10

and Liebert with 13.31%, Hitachi has 8.62%, Consul 7.67%, AVO 4.87%,

Eaton 3.47% & so on as shown in graph above. While other major players

account for rest.

SD ESTIMATES

Softdisk had predicted in June 2016 that the total industry revenue

will cross INR 5500 crore mark by March, 2017. We talked to Industry

Captains trying to know what the Industry leaders thought. Many had

little or no doubt to what Softdisk has predicted earlier, even though

this response was at time when the global economies were trying to come

out of worst ever economic crises, and Indian market was also shaken by

demonetization and fear GST Impact. As on date we feel that nearing

5442.87 crore mark for end-user sales and 5700 crore mark including

secondary sales was quiet a close prediction. Softdisk remains committed

to transparent reporting, in-depth analysis and always throwing up

forecast & estimates which you can Rely Upon.

We have Faith, You Rely on us, We Rely on facts.

According to Mr. Rajaram Rammurthy, MD E&C With the government GST has

been introduced since July 1, 2017. Though this was in the air for quite

some time, the fact that GST will be implemented from July 1, 2017 for

sure was clear only during the last week of June 2017. Given the size of

Indian economy and the way business is done in India, the side effects

of a poorly planned implementation was not thought through. Too many

changes in too small a time. More so, the penal provisions which are

incorporated are too stringent and given the discipline that is

currently, it is not possible to adhere without a large working capital. According to Mr. Rajaram Rammurthy, MD E&C With the government GST has

been introduced since July 1, 2017. Though this was in the air for quite

some time, the fact that GST will be implemented from July 1, 2017 for

sure was clear only during the last week of June 2017. Given the size of

Indian economy and the way business is done in India, the side effects

of a poorly planned implementation was not thought through. Too many

changes in too small a time. More so, the penal provisions which are

incorporated are too stringent and given the discipline that is

currently, it is not possible to adhere without a large working capital.

The tax laws in India have always been unclear especially with the

applicable rates for various products. This invariably gave a lot of

room for the tax authorities to harass at the time of assessment which

happens after several years. By then lot of damage has already happened

and the manufacturers are left with no other option than to go to the

courts for remedy which in general takes a lot of resources to fight.

This aspect of vagueness in tax rates has not changed and such

uncertainties prevail in the GST regime as well.

On the issue of Input tax credit he states that as compared to the

previous tax regime, the input tax credit is available only when the

suppliers pay their output tax. The system was easier in the previous

tax regime where the input tax could be taken as credit when the goods

are received inward. The system was not costing anything to the

Government as the tax had to be paid sooner or later by the suppliers

with applicable interest and penalties. Currently, in the current tax

regime, tax should be paid by the suppliers so that the tax can be taken

as credit by the customer. With the credit squeeze and poor liquidity,

this is a problem for most tax payers as there is uncertainty on the

availability of the tax credit as suppliers may not have the liquidity

to pay the taxes.

On the he adds, As we are in the services sector and UPS being vital for

any business, we could not move the service engineers as they have to be

fed with cash and cash was not available in the ATMs even if the funds

were in their accounts. Services took a huge hit with respect to time.

In most cases, we had to request the our Bank Customers to help us with

the required cash to get the work done for Bank and other Customers.

While the Government says that one has to suffer the short term pain for

long term gains, the entire preparation for this exercise could have

been done better.

Talking on the subject of slowdown in the market Mr. N K Agrawal of

Delhi based Microtek laments that in 2016-17 market has been slowed down

and was not buoyant. With the introduction of GST he hopes that

unorganized sector will reduce and in the long run GST will benefit the

branded organized players. On the question Input tax credit he believes

ITC is quite appropriate but net result we will be able to access after

few months of the GST rates being applicable. On the other hand he lauds

BIS introduction as in UPS segment as such the unorganized market has

been marginalized because of low profit margins, hence BIS has allowed

the organized players like Microtek to play safe. With all this (Slowing

down of Economy, Demonetization & introduction of GST), he still feel

that the UPS Segment will show a growth in coming years also all though

not in double digit. We have to give some time to the new govt at the

center which is reformist & is trying its best to bring back the economy

back on track. (Here it is worth mentioning that Softdisk figure does

not include the revenue generated by Inverters, which too is effected by

the slow down.) As regards to our expansion we have already come up with

complete range of Solar products he laments. Talking on the subject of slowdown in the market Mr. N K Agrawal of

Delhi based Microtek laments that in 2016-17 market has been slowed down

and was not buoyant. With the introduction of GST he hopes that

unorganized sector will reduce and in the long run GST will benefit the

branded organized players. On the question Input tax credit he believes

ITC is quite appropriate but net result we will be able to access after

few months of the GST rates being applicable. On the other hand he lauds

BIS introduction as in UPS segment as such the unorganized market has

been marginalized because of low profit margins, hence BIS has allowed

the organized players like Microtek to play safe. With all this (Slowing

down of Economy, Demonetization & introduction of GST), he still feel

that the UPS Segment will show a growth in coming years also all though

not in double digit. We have to give some time to the new govt at the

center which is reformist & is trying its best to bring back the economy

back on track. (Here it is worth mentioning that Softdisk figure does

not include the revenue generated by Inverters, which too is effected by

the slow down.) As regards to our expansion we have already come up with

complete range of Solar products he laments.

According to Mr. Amitansu Satpathy, Managing Director BPE, his company

follows the concept of economy of scale ensuring right product and right

quality. BPE manufactures its products from Best manufacturing unit

available in China, Taiwan, Italy & Turkey. Our factories are equipped

with high speed SMT production lines and the best available online

automatic testing equipments resulting in high quality error free

production. BPE has a capacity of manufacturing UPS up to 500 kVA along

with battery banks, harmonics filters, accessories and allied products

to provide an end to end power backup solution. According to Mr. Amitansu Satpathy, Managing Director BPE, his company

follows the concept of economy of scale ensuring right product and right

quality. BPE manufactures its products from Best manufacturing unit

available in China, Taiwan, Italy & Turkey. Our factories are equipped

with high speed SMT production lines and the best available online

automatic testing equipments resulting in high quality error free

production. BPE has a capacity of manufacturing UPS up to 500 kVA along

with battery banks, harmonics filters, accessories and allied products

to provide an end to end power backup solution.

In addition to providing technologically superior, quality products that

meets the global standards, BPE's Power Solutions helps meet another

dimension of business needs today - On time and short delivery times.

Current day business needs require that projects are completed on time

as projects overruns lead to an unprecedented opportunity loss in

Telecom, IT setups, Data Centers, Medical establishments and Industry at

large. During demonetizations we faced difficulties for was lack of cash

for local transportation of products, where cash was needed and

maintenance was effected. GST application we are satisfied with 18% flat

single tax for UPS. However we feel, it would really help if Batteries

could also be brought at 18% tax slab.

According to Mr. Narayan Sabhahit Managing Director, Techser Power

Solutions Pvt. Ltd, Bangalore, believes that after the tough financial

year of 2015-2016 was very challenging year due to high volatility in

the market and fierce competition for top-line pie. Demonetizations also

worked against the interest, as orders thou approved were not forth

coming till things settled down by January end a major reason for our

dip in growth. Banks have always squeezed the SMEs. Business has come to

an abysmal low in the country, with little or no stocks at the end of

June 2017. As it is we had to reduce our stock levels of raw material or

finished goods as the rules were uncertain. There was no attempt by the

Government to make things clear so as to not have a dip in production

output. The tax structures should have been made simpler with one rate

of tax for all products which should have made the system lot easier and

does not involve much overhead for the Government during assessment

which could have been easily done online. According to Mr. Narayan Sabhahit Managing Director, Techser Power

Solutions Pvt. Ltd, Bangalore, believes that after the tough financial

year of 2015-2016 was very challenging year due to high volatility in

the market and fierce competition for top-line pie. Demonetizations also

worked against the interest, as orders thou approved were not forth

coming till things settled down by January end a major reason for our

dip in growth. Banks have always squeezed the SMEs. Business has come to

an abysmal low in the country, with little or no stocks at the end of

June 2017. As it is we had to reduce our stock levels of raw material or

finished goods as the rules were uncertain. There was no attempt by the

Government to make things clear so as to not have a dip in production

output. The tax structures should have been made simpler with one rate

of tax for all products which should have made the system lot easier and

does not involve much overhead for the Government during assessment

which could have been easily done online.

However we consciously decided to avoid any 'cut-throat' competition

paradigm. We diligently decided that it is better to work on healthy

orders rather that 'vanity orders' which could only boost top-line but

adversely affecting bottom-line. The year also has been a year of

consolidation with respect to our restructuring manufacturing and

services offerings. We tried to strengthen our work force wherever

required which enabled us to bounce back in to the market more strongly.

What made us feel better was having a stable government at the center

will aid in better confidence for foreign companies to invest in India.

India has been an attractive destination for long for several foreign

companies, but the major problem has been the red tape in conducting

business as the laws of the land have been inherently quite ambiguous

even for Indian Companies and entrepreneurs. In this regard introduction

of BIS registration for up to 5 k.Va of UPS's being made Mandatory is

welcome sign. The Objective in particular is correct that products meet

certain safety standards. However, the formulation of the process could

have been better. They should have been more specific. I feel that the

important line of products that need to be certified for Safety are the

equipments used for homes. They are mainly off the shelf products which

conform to a certain configuration. Online UPS are used for specific

commercial purposes in a supervised environment compared to a home UPS /

Inverter. Hence they are not standard off-the-shelf products in the

Indian context.

According to Mr. R K Bansal Managing Director Uniline Energy Systems

Pvt. Ltd. elaborated on this issue, according to him when we speak about

market, we have an enterprise market segment in mind. Most of the top

notch UPS companies like APC, Eaton, Numeric etc to some extent mostly

serve this business segment. Our strength lies in Govt. sector & PSUs.

As per our understanding, the market segment revenue (excluding

precision A/C, Electrical distribution, etc.) for UPS Systems is close

to INR5000 Cr. Looking at the present market scenario, the revenue

collection from this segment shall be within INR 3500 to 5000 Crore in

the current fiscal this year. We had a tough time this year with revenue

falling by over 30% in 2014-15, however we able to arrest this trend as

the dip was merely 1% in 2015-16, however in 2016-17 we again suffered a

dip of over 19% due to demonetizations process. GST is good news but 18%

tax slab for UPS and batteries would have been ideal. ITC of sales done

under previous tax regime was is a cause of worry, with such huge tax

reform, govt should have come up better prepared. Currently there is

more emphasis on best utilization of existing IT facilities and also

human resource. Governments buying has also gone down. In BIS

requirement the awareness and understanding is missing among several UPS

manufacturers and several smaller players are not aware of such

requirements. In addition, the home users' awareness that only BIS

certified / registered products should be bought is also low. According to Mr. R K Bansal Managing Director Uniline Energy Systems

Pvt. Ltd. elaborated on this issue, according to him when we speak about

market, we have an enterprise market segment in mind. Most of the top

notch UPS companies like APC, Eaton, Numeric etc to some extent mostly

serve this business segment. Our strength lies in Govt. sector & PSUs.

As per our understanding, the market segment revenue (excluding

precision A/C, Electrical distribution, etc.) for UPS Systems is close

to INR5000 Cr. Looking at the present market scenario, the revenue

collection from this segment shall be within INR 3500 to 5000 Crore in

the current fiscal this year. We had a tough time this year with revenue

falling by over 30% in 2014-15, however we able to arrest this trend as

the dip was merely 1% in 2015-16, however in 2016-17 we again suffered a

dip of over 19% due to demonetizations process. GST is good news but 18%

tax slab for UPS and batteries would have been ideal. ITC of sales done

under previous tax regime was is a cause of worry, with such huge tax

reform, govt should have come up better prepared. Currently there is

more emphasis on best utilization of existing IT facilities and also

human resource. Governments buying has also gone down. In BIS

requirement the awareness and understanding is missing among several UPS

manufacturers and several smaller players are not aware of such

requirements. In addition, the home users' awareness that only BIS

certified / registered products should be bought is also low.

With the implementation of GST, Mr. Sriram Ramakrishnan, MD, Consul is

very upbeat. But feels that Govt should have educating the account

professionals and also built up more robust Software and Hardware

infrastructure. Today tax payer is confused lot with too many changes in

too small a time. More so, the penal provisions which are incorporated

are too stringent and given the discipline that is currently, it is not

possible to adhere without a large working capital. The tax laws in

India have always been unclear especially with the applicable rates for

various products. No where in the HSN listing the term Solar Inverter is

used, which is a separate product in itself. Should we charge at 5% or

28%, he questions. This invariably gives a lot of room for the tax

authorities to harass at the time of assessment which happens after

several years. By then lot of damage has already happened and the

manufacturers are left with no other option than to go to the courts for

remedy which in general takes a lot of resources to fight. With the implementation of GST, Mr. Sriram Ramakrishnan, MD, Consul is

very upbeat. But feels that Govt should have educating the account

professionals and also built up more robust Software and Hardware

infrastructure. Today tax payer is confused lot with too many changes in

too small a time. More so, the penal provisions which are incorporated

are too stringent and given the discipline that is currently, it is not

possible to adhere without a large working capital. The tax laws in

India have always been unclear especially with the applicable rates for

various products. No where in the HSN listing the term Solar Inverter is

used, which is a separate product in itself. Should we charge at 5% or

28%, he questions. This invariably gives a lot of room for the tax

authorities to harass at the time of assessment which happens after

several years. By then lot of damage has already happened and the

manufacturers are left with no other option than to go to the courts for

remedy which in general takes a lot of resources to fight.

This aspect of vagueness in tax rates has not changed and such

uncertainties prevail in the GST regime as well. As regards

demonetizations it was temporary phase where some cash related

transactions for local transportation of product and maintenance issue

were effected. However major order were also put on hold as Banks were

busy handling the old notes exchange pressure. But overall we did not

phase any dip in sales or anything to complain. The move towards

mandatory BIS for UPS upto 5kva has cleared up a lot of air by bringing

in standards for the product. It has reduced but not totally eliminated

the so called "fly by night" operators, that can only be achieved

through a program to educate customers as a lot of customers adopt a

price first stance for evaluating and buying a UPS, he laments. Price is

the key in a commodity market. A UPS is not a commodity especially for

the larger 3 phase or Enterprise Class UPS. The Chinese effect is strong

in the small single phase UPS and lower capacity three phase segment as

the domestic manufacturers were caught on the wrong foot with old

technology and high prices. In this segment it will be a challenge to

match the Chinese players on price keeping in mind the infrastructure

and manufacturing scale that they have built. With no differentiation in

technology and features, single phase and smaller three phase UPS has

become a commodity product with low margins. The enterprise class UPS

segment is at the other end and dominated by European and American

MNC's. Growth of the Indian UPS industry has been anemic for the last

two years. This has forced many UPS players to diversify. But with now

signs of economic growth, we look forward to at least strong single

digit growth this year and next, he laments.

Implementing GST is being made Mandatory, it is good for Branded /

Manufacturing Companies as a whole. As a growing market, India is our

main focus of attention. The main advantage is we have our own

manufacturing plant with our own separate design, R&D and implementation

teams. If there is a demand for a new design, we can get that ready

within speculated time. These factors place us a notch above the rest in

the market. Another advantage of GST is a major challenge faced by

Indian UPS market is the import of cheaper systems, local brand with

poor quality products, competition from unorganized sectors, fluctuating

commodity prices etc. But due to GST implementation made mandatory, the

companies have become organized and aggressively pushing their products

at a reasonable price and with advance technology. As a result, small

URD companies and "fly by night" operators will be unable to cope up

with this situation and will lose ground. For taxation, GST Slab for UPS

is 18%. In this regard introduction of GST 28% is for UPS's with

batteries and we believe it should also be lowered to 18%. This will

help to rationalize the quality of products, he laments. He further

adds, We are GST Complaint. In the GST system, taxes for both Center and

State will be collected at the point of sale. Both will be charged on

the manufacturing cost. Individuals will be benefitted by this as prices

are likely to come down and lower prices mean more consumption, and more

consumption means more production, thereby helping in the growth of the

companies. Implementing GST is being made Mandatory, it is good for Branded /

Manufacturing Companies as a whole. As a growing market, India is our

main focus of attention. The main advantage is we have our own

manufacturing plant with our own separate design, R&D and implementation

teams. If there is a demand for a new design, we can get that ready

within speculated time. These factors place us a notch above the rest in

the market. Another advantage of GST is a major challenge faced by

Indian UPS market is the import of cheaper systems, local brand with

poor quality products, competition from unorganized sectors, fluctuating

commodity prices etc. But due to GST implementation made mandatory, the

companies have become organized and aggressively pushing their products

at a reasonable price and with advance technology. As a result, small

URD companies and "fly by night" operators will be unable to cope up

with this situation and will lose ground. For taxation, GST Slab for UPS

is 18%. In this regard introduction of GST 28% is for UPS's with

batteries and we believe it should also be lowered to 18%. This will

help to rationalize the quality of products, he laments. He further

adds, We are GST Complaint. In the GST system, taxes for both Center and

State will be collected at the point of sale. Both will be charged on

the manufacturing cost. Individuals will be benefitted by this as prices

are likely to come down and lower prices mean more consumption, and more

consumption means more production, thereby helping in the growth of the

companies.

GST is one of the greatest reform happened in India in Tax front. For a

manufacturer like Hykon, GST tax system is a great relief. We find GST

easy to implement compared to VAT, Central excise etc. With GST it is

not easy to evade tax. So level of playing ground becomes same for all.

The cost advantage for smaller players was the tax amount. So once

everyone starts paying tax, the cost advantage of many smaller players

or bigger players goes. GST was introduced to make tax system single

with one or 2 slabs. But the same product like battery comes in

different slab, which the GST system is complicated. All battery should

be made one slab. Otherwise the Government is giving ways for

complications in future. In future with introduction of Lithium-ion

battery, same battery can be used in vehicles and UPS. For UPS systems

it is good, GST is fixed at 18%. The reason is for smaller companies

which were not paying central excise were enjoying only VAT 5%- it

becomes hard, as the selling price will have to be revised for an

increase of 23%. But for companies like Hykon who were paying 12.5%

Central excise and 14.5% VAT on Kerala, GST will not make any big

difference., he laments. GST is one of the greatest reform happened in India in Tax front. For a

manufacturer like Hykon, GST tax system is a great relief. We find GST

easy to implement compared to VAT, Central excise etc. With GST it is

not easy to evade tax. So level of playing ground becomes same for all.

The cost advantage for smaller players was the tax amount. So once

everyone starts paying tax, the cost advantage of many smaller players

or bigger players goes. GST was introduced to make tax system single

with one or 2 slabs. But the same product like battery comes in

different slab, which the GST system is complicated. All battery should

be made one slab. Otherwise the Government is giving ways for

complications in future. In future with introduction of Lithium-ion

battery, same battery can be used in vehicles and UPS. For UPS systems

it is good, GST is fixed at 18%. The reason is for smaller companies

which were not paying central excise were enjoying only VAT 5%- it

becomes hard, as the selling price will have to be revised for an

increase of 23%. But for companies like Hykon who were paying 12.5%

Central excise and 14.5% VAT on Kerala, GST will not make any big

difference., he laments.

On BIS standard is good. But I don't know the profitability will

increase. The reason is the UPS had entered into a matured market where

the profit becomes very thin and small capacity volume of UPS is coming

down as the use of desktop is going down. The main drawback for Indian

companies to make UPS in India is the lack of technology. 80-90% of High

frequency UPS selling in India is imported, not manufactured. Even there

are more than 800 UPS companies in India, no one have the right

technology. What Government should do it source or develop indigenous

High frequency Technology and provide this to all UPS manufacturers.

This will strengthen the UPS manufacturer in India and stop imports. We

can compete with China as the manufacturing cost of China is going up,

which make Indian UPS competitive., he adds.

He further adds many companies including us are solar is the diminishing

profit margins of UPS. The solar system have almost same contents. It

also need installation and service which UPS industry is familiar with.

But in Solar the biggest challenge will be working capital as collection

takes more time as it is a project. So for UPS industry it's good to

move into Solar, if sufficient capital is there.

According to Mr. Rabindra Agrawal, MD Switching Avo as GST has been

introduced since July 1, 2017. Given the size of Indian economy and the

way business is done in India, the side effects of a poor implementation

was not thought through. Too many changes in too small a time. More so,

the penal provisions which are incorporated are too stringent and given

the Indian attitude, it is not possible to adhere without a large

working capital. Working capital, in itself, in India is an issue for

small and medium enterprises, with their customers purchasing on credit

and payment periods are uncertain. However he further adds, we have been

observing strict discipline over credits and payments, which makes our

suppliers trust us even in tough times. Since GST warranted change in IT

systems, many organizations have implemented changes without taking into

account the challenges that they would face over migration from the

CST/VAT regime to GST. Many Public sector units and corporate are

harassing the suppliers with non-payment for invoices raised in the CST

regime and have kept those pending without knowing how to handle them.

This has put many of their suppliers in distress, laments. According to Mr. Rabindra Agrawal, MD Switching Avo as GST has been

introduced since July 1, 2017. Given the size of Indian economy and the

way business is done in India, the side effects of a poor implementation

was not thought through. Too many changes in too small a time. More so,

the penal provisions which are incorporated are too stringent and given

the Indian attitude, it is not possible to adhere without a large

working capital. Working capital, in itself, in India is an issue for

small and medium enterprises, with their customers purchasing on credit

and payment periods are uncertain. However he further adds, we have been

observing strict discipline over credits and payments, which makes our

suppliers trust us even in tough times. Since GST warranted change in IT

systems, many organizations have implemented changes without taking into

account the challenges that they would face over migration from the

CST/VAT regime to GST. Many Public sector units and corporate are

harassing the suppliers with non-payment for invoices raised in the CST

regime and have kept those pending without knowing how to handle them.

This has put many of their suppliers in distress, laments.

On the issue of Reverse Auction fast becoming the new normal for

purchase he believes that the only way customers can be spoken out of is

by explaining the demerits of Reverse Auction and making them

understand. (1) In some tenders, customer is procuring at prices which

are higher than what they would otherwise procure in closed tenders. (2)

Customers are getting supplies which are compromised in terms of

specifications which they are unaware. On the Supplier's side, (a) the

reverse auctions are just too time consuming, sometimes the process

takes almost a full day, (b) too much dependence on network/internet

connectivity and infrastructure issues (c) Customers themselves setting

unrealistic starting bid prices.

BIS certification is a welcome initiative by the government. This will

ensure that all goods are safe to be used by the the end users. However

lack of testing centres / facilities coupled with vast inventory vide

importing by thousand of Indian vendors will make it extremely difficult

for importer to get a BIS certificate timely. However he does not think

so that BIS certification will throw out small players. Yes, may be fly

by night operators will be thrown out. I feel even if small time

manufacturer, if they have a good system with satisfactory procedures,

BIS certificate will be a blessing and eventually the BIS can be a big

tool to improve the small/medium manufacturer.

He adds service & support are our forte. Third Party Servicing /

Maintenance is a concept that is emerging since the last few years. Big

Customers adopt this concept to ensure single point of contact for

maintenance to ensure that they concentrate on their core competency. It

is a good option, as long all UPS are serviceable by anybody. We have

taken this to a new level, by introducing App oriented services. Several

big service companies are adopting this and the concept is catching up.

This is mainly because of poor understanding and trivializing the

important issue. Most organizations are becoming too sensitive to costs

and are taking hasty decisions to award support to third parties he

laments.

According to Dr. Kazuhiro Imaie, CEO, Hitachi-Hi-Rel, today Indian power

conditioning market is getting more sensitive and mature to the evolving

needs of the businesses. With India assuming a key role in the Asian

economy, businesses have become attuned to the fact that they need to be

robust in terms of infrastructure to attract and retain investors.

Hence, Business Critical Continuity is being viewed strategically and

upcoming businesses are realizing the importance of factoring and

aligning it as key component in the overall business model. Adding

further they say we view the present market scenario as an opportunity

to strengthen our company's presence in Industrial market segment.

Extremely low prices are unsustainable if quality/service levels are to

be maintained. Price erosion beyond a point hurts all stake holders -

manufacturers, channel partners, customers, etc. If it continues beyond

a point it will lead to disastrous consequences for vendors. We have

taken a wise decision not to take up orders were we have to cut down on

margins this has lead to increased profitability where we are successful

to a great extent and the results are showing but top line takes the

hit. We have been showing strong performance in the Solar Power Control

Units (SPCU) arena. According to Dr. Kazuhiro Imaie, CEO, Hitachi-Hi-Rel, today Indian power

conditioning market is getting more sensitive and mature to the evolving

needs of the businesses. With India assuming a key role in the Asian

economy, businesses have become attuned to the fact that they need to be

robust in terms of infrastructure to attract and retain investors.

Hence, Business Critical Continuity is being viewed strategically and

upcoming businesses are realizing the importance of factoring and

aligning it as key component in the overall business model. Adding

further they say we view the present market scenario as an opportunity

to strengthen our company's presence in Industrial market segment.

Extremely low prices are unsustainable if quality/service levels are to

be maintained. Price erosion beyond a point hurts all stake holders -

manufacturers, channel partners, customers, etc. If it continues beyond

a point it will lead to disastrous consequences for vendors. We have

taken a wise decision not to take up orders were we have to cut down on

margins this has lead to increased profitability where we are successful

to a great extent and the results are showing but top line takes the

hit. We have been showing strong performance in the Solar Power Control

Units (SPCU) arena.

According to Mr. I B Rao & Mr. M R Rajesh of Power One Micro Systems

Pvt. Ltd. opines that Softdisk has a scientific approach towards market

analysis, for its volume and revenue of the UPS Market (UPS + Batteries

and service sales). Mr. I B Rao opines implementing GST is being made

Mandatory, it is good for Branded / Manufacturing Companies as a whole.

Advantage of GST is a major challenge faced by Indian UPS market is the

import of cheaper systems, local brand with poor quality products,

competition from unorganized sectors, fluctuating commodity prices etc.

But due to GST implementation made mandatory, the companies have become

organized and aggressively pushing their products at a reasonable price

and with advance technology. As a result, small unorganized companies

and "fly by night" operators will be unable to cope up with this

situation and will lose ground. For taxation, GST Slab for UPS is 18%.

In this regard introduction of GST 28% is for UPS's with batteries and

we believe it should also be lowered to 18%. This will help to

rationalize the quality of products, he laments. He further adds, but in

case of Solar inverter, there is lot of confusion, our GST planners

should not only used tax professionals but also IIT educated electronic

graduates to classify, Static Inverter, SPCU when supplied with EPC as

project, separately. Or one slab of 18% for all electronic equipments

including batteries would have solved the problem. But confusion still

prevails. It is only after first GST audit that we will come to know the

real classifications. According to Mr. I B Rao & Mr. M R Rajesh of Power One Micro Systems

Pvt. Ltd. opines that Softdisk has a scientific approach towards market

analysis, for its volume and revenue of the UPS Market (UPS + Batteries

and service sales). Mr. I B Rao opines implementing GST is being made

Mandatory, it is good for Branded / Manufacturing Companies as a whole.

Advantage of GST is a major challenge faced by Indian UPS market is the

import of cheaper systems, local brand with poor quality products,

competition from unorganized sectors, fluctuating commodity prices etc.

But due to GST implementation made mandatory, the companies have become

organized and aggressively pushing their products at a reasonable price

and with advance technology. As a result, small unorganized companies

and "fly by night" operators will be unable to cope up with this

situation and will lose ground. For taxation, GST Slab for UPS is 18%.

In this regard introduction of GST 28% is for UPS's with batteries and

we believe it should also be lowered to 18%. This will help to

rationalize the quality of products, he laments. He further adds, but in

case of Solar inverter, there is lot of confusion, our GST planners

should not only used tax professionals but also IIT educated electronic

graduates to classify, Static Inverter, SPCU when supplied with EPC as

project, separately. Or one slab of 18% for all electronic equipments

including batteries would have solved the problem. But confusion still

prevails. It is only after first GST audit that we will come to know the

real classifications.

Mr. Rajesh further adds : In the battle to capture the customer,

Indian companies are using a wide range of tactics to ward off

competitors. Increasingly, price is the weapon of choice and frequently

the skirmishing degenerates into a price war. Creating low-price appeal

is often the goal, but the result of one retaliatory price slashing

after another is often a precipitous decline in industry profits. Price

wars can create economically devastating and psychologically

debilitating situations that take an extraordinary toll on an

individual, a company, and industry profitability. No matter who wins,

the combatants all seem to end up worse off than before they joined the

battle. And yet, price wars are becoming increasingly common and

uncommonly fierce. We have made it a point not to burn our fingers in

such price wars. We concentrate on bottom line an that is how it works

for us. Mr. Rajesh further adds : In the battle to capture the customer,

Indian companies are using a wide range of tactics to ward off

competitors. Increasingly, price is the weapon of choice and frequently

the skirmishing degenerates into a price war. Creating low-price appeal

is often the goal, but the result of one retaliatory price slashing

after another is often a precipitous decline in industry profits. Price

wars can create economically devastating and psychologically

debilitating situations that take an extraordinary toll on an

individual, a company, and industry profitability. No matter who wins,

the combatants all seem to end up worse off than before they joined the

battle. And yet, price wars are becoming increasingly common and

uncommonly fierce. We have made it a point not to burn our fingers in

such price wars. We concentrate on bottom line an that is how it works

for us.

According Mr. Shankar Nagali, Cosmic Micro Systems, now a days we see

service tenders being floated separately many a companies import low

quality products, install and maintain it for three year and leave the

scene giving rise to such service tenders being floated. He was very

vocal on the subject of third party maintenance that it is common

knowledge that, though UPS being a proven technological concept, differs

in its construction based on manufacturer. Components for spares

sometimes become inaccessible leading to servicing difficulties

resulting in replacement of a UPS with another equivalent product. This

method proves costly for the maintenance vendor and the customer loses

the original asset quality which is not clearly visible during the life

of the maintenance contract. This is a perceived loss to the customer.

UPS OEMs on the other hand lose their valuable service revenue which was

hitherto their assured income. However with the advent of GST we believe

this practice will come to an end. According Mr. Shankar Nagali, Cosmic Micro Systems, now a days we see

service tenders being floated separately many a companies import low

quality products, install and maintain it for three year and leave the

scene giving rise to such service tenders being floated. He was very

vocal on the subject of third party maintenance that it is common

knowledge that, though UPS being a proven technological concept, differs

in its construction based on manufacturer. Components for spares

sometimes become inaccessible leading to servicing difficulties

resulting in replacement of a UPS with another equivalent product. This

method proves costly for the maintenance vendor and the customer loses

the original asset quality which is not clearly visible during the life

of the maintenance contract. This is a perceived loss to the customer.

UPS OEMs on the other hand lose their valuable service revenue which was

hitherto their assured income. However with the advent of GST we believe

this practice will come to an end.

According to Mr. Vinod of Arvi GST is one of the greatest reform ever

happened in India in Tax front. For a manufacturer like Arvi, GST tax

system is a great relief. We find GST easy to implement compared to VAT,

Central excise etc. With GST it is not easy to evade tax. So level of

playing ground becomes same for all. The cost advantage for smaller

players was the tax amount. So once everyone starts paying tax, the cost

advantage of many smaller players or bigger players goes. In future with

introduction of Lithium-ion battery, same battery can be used in

vehicles and UPS. For UPS systems it is good, GST is fixed at 18%. The

reason is for smaller companies which were not paying central excise

were enjoying only VAT 5%, it becomes hard, as the selling price will

have to be revised now. BIS standard is a good introduction. But I don't

know weather the profitability will increase. The reason is the UPS had

entered into a matured market where the profit becomes very thin and

small capacity volume of UPS is coming down as the use of desktop is

going down. The main drawback for Indian companies to make UPS in India

is the lack of technology. 80-90% of High frequency UPS selling in India

is imported, not manufactured but it is not so at Arvi, we have

developed our own cards. With a single card three phase output with

IGBT, double conversion technology. You can actually see these cards

being manufactured in front of your eyes. Vinod Kumar of ARVI has setup

a 100% EOU for exporting Online UPS and solar solutions. ARVI has also

commissioned solar solution for irrigation purposes, which has a huge

potential apart from enhancing its market share in niche products

specially designed for medical and industrial sectors for critical

applications. According to Mr. Vinod of Arvi GST is one of the greatest reform ever

happened in India in Tax front. For a manufacturer like Arvi, GST tax

system is a great relief. We find GST easy to implement compared to VAT,

Central excise etc. With GST it is not easy to evade tax. So level of

playing ground becomes same for all. The cost advantage for smaller

players was the tax amount. So once everyone starts paying tax, the cost

advantage of many smaller players or bigger players goes. In future with

introduction of Lithium-ion battery, same battery can be used in

vehicles and UPS. For UPS systems it is good, GST is fixed at 18%. The

reason is for smaller companies which were not paying central excise

were enjoying only VAT 5%, it becomes hard, as the selling price will

have to be revised now. BIS standard is a good introduction. But I don't

know weather the profitability will increase. The reason is the UPS had

entered into a matured market where the profit becomes very thin and

small capacity volume of UPS is coming down as the use of desktop is

going down. The main drawback for Indian companies to make UPS in India

is the lack of technology. 80-90% of High frequency UPS selling in India

is imported, not manufactured but it is not so at Arvi, we have

developed our own cards. With a single card three phase output with

IGBT, double conversion technology. You can actually see these cards

being manufactured in front of your eyes. Vinod Kumar of ARVI has setup

a 100% EOU for exporting Online UPS and solar solutions. ARVI has also

commissioned solar solution for irrigation purposes, which has a huge

potential apart from enhancing its market share in niche products

specially designed for medical and industrial sectors for critical

applications.

Mr. Y B Suresh, Director Total Power Conditioners Pvt. Ltd. believes

that GST will avoid multiple taxation in different parts of then country

and make business simple and seamless across the country and will not

have to face competition from Fly-by-Night operators who evade tax and

give extremely low rates will be greatly reduced. But he is skeptic on

ITC refund. Input credit for products like Solar PCU with all input RAW

materials available at 18 to 28% slab and out put tax is at 5% will make

the manufacturer eligible for refund, so an average refund will be 10 -

14 % of the company's turnover so for small scale industries this is a

burden if the refunds are not happening on Quarterly basis. Ex: if any

manufacturer is doing a T/O of 5 crores then yearly refund will be 50 to

70 Lakhs. It is natural for the companies to move towards Solar as solar

product with few more technical components compare to UPS and enhancing

the profit margin, this trade is familiar terrain for UPS Manufacturers,

he laments. He further adds because solar is picking up in fast pace so

UPS may be replaced with SOLAR PCUs and country is moving from power

shortage to power surplus UPS requirement may gradually going down from

present level Other way around because of industrialization is also

picking UP and may push the demand for the UPS In both the cases people

from the UPS industry are working so we can expect it to grow. Mr. Y B Suresh, Director Total Power Conditioners Pvt. Ltd. believes

that GST will avoid multiple taxation in different parts of then country

and make business simple and seamless across the country and will not

have to face competition from Fly-by-Night operators who evade tax and

give extremely low rates will be greatly reduced. But he is skeptic on

ITC refund. Input credit for products like Solar PCU with all input RAW

materials available at 18 to 28% slab and out put tax is at 5% will make

the manufacturer eligible for refund, so an average refund will be 10 -

14 % of the company's turnover so for small scale industries this is a

burden if the refunds are not happening on Quarterly basis. Ex: if any

manufacturer is doing a T/O of 5 crores then yearly refund will be 50 to

70 Lakhs. It is natural for the companies to move towards Solar as solar

product with few more technical components compare to UPS and enhancing

the profit margin, this trade is familiar terrain for UPS Manufacturers,

he laments. He further adds because solar is picking up in fast pace so

UPS may be replaced with SOLAR PCUs and country is moving from power

shortage to power surplus UPS requirement may gradually going down from

present level Other way around because of industrialization is also

picking UP and may push the demand for the UPS In both the cases people

from the UPS industry are working so we can expect it to grow.

According to Mr. K M Krishnamurthy Managing Director, Powernet Solutions

Pvt. Ltd. Bangalore, believes that "In the past year the net materials

cost of all the products gone up and we are taking all cost cutting

measures to control the pricing and offer great value to customers." We

are doing reverse engineering and research to check all the

possibilities to reduce cost without compromising on quality, he

laments. Flow going, some people started quoting very low. But surely

they can not repeat and sustain but certainly some of major companies

could do it for long time. That is to play a different game to keep the

share price high at the international exchange. Even they have to revert

back at some point of time. We are focusing on diversified market

segment like Lift Control Logic with UPS, Solar PCUs and closely working

with few OEM buyers in that segment and working on new design to reduce

cost of production and support small time OEM buyers. According to Mr. K M Krishnamurthy Managing Director, Powernet Solutions

Pvt. Ltd. Bangalore, believes that "In the past year the net materials

cost of all the products gone up and we are taking all cost cutting

measures to control the pricing and offer great value to customers." We

are doing reverse engineering and research to check all the

possibilities to reduce cost without compromising on quality, he

laments. Flow going, some people started quoting very low. But surely

they can not repeat and sustain but certainly some of major companies

could do it for long time. That is to play a different game to keep the

share price high at the international exchange. Even they have to revert

back at some point of time. We are focusing on diversified market

segment like Lift Control Logic with UPS, Solar PCUs and closely working

with few OEM buyers in that segment and working on new design to reduce

cost of production and support small time OEM buyers.

Mr. Palash Nandy has 28 years of rich experience in Sales, Marketing and

Strategic Planning at Legrand, Who joined the Legrand group in 1990 as a

Sales Trainee in Kolkata. Subsequently he has many positions in Sales

and Marketing in India. His last assignment before Numeric was at the

Group HQ in France as Group VP Strategic Planning. Effective July 2016

he has taken over as CCO of Numeric which is a group brand of Legrand.

According to him Softdisk is the oldest and largest circulated magazine

and it gives a wide range of information from latest product news to

in-depth articles on power electronic industry and its reviews &

forecasts. The publication has been conducting surveys in the various

segments of Power, Solar & IT Industry and coming up with SD Awards.

These surveys provide an in-depth analysis of the some segments of the

Industry and users utilize it as one of their decision making tools and

also as a guide of the Industry.

Softdisk is of the view demonetization, GST,

Cut Throat Competition or what ever UPS is an CAPITAL EQUIPMENT and not

a box pushing activity. In the absence of a detailed technical selling

and service center audits, Some certification & Standards which can be

purchased without even performance, reverse auction becomes a simple

number game for everyone. This will lead to killing the very industry

practice itself and the customers will realize this after few years

later. If this is for computer stationery (or) purchase of tube lights

etc then the reverse auction is Ok as most competitive bidder will sell

more.

Softdisk believes that being a negligible contributor to the GDP, Power

Electronic Industry does not receive enough attention from the Govt., we

believe the Govt. should realize the importance of Power Continuity with

Quality as it is the life line of major GDP contributors. Softdisk has

seen it all over the past two & a half decades, more often then not some

of the companies use a lot of word jugglery in there promos, it must be

the same thing which some one else must be offering without making lot

of noise and at a better price. It is one area where customers need to

be watchful. Softdisk believes that if Manufacturers mad rush for sale

will only decrease their profits and ultimately lead to their collapse.

So UPS business is not rosy and bright but has still not lost its

potential and will stay for ever.

|